The fastest and most convenient way to pay for the services of the mobile operator A1 (Velcom) is to pay by bank card via the Internet. You can also top up your balance using the card through terminals or cash desks of banks and post offices (Belpochta).

Next, we will look at all possible payment methods for A1 communication services available to residents of Belarus.

5 ways to pay for A1 operator services:

- via the Internet using a card;

- online banking (ERIP);

- at post offices (via a cashier or terminal);

- at bank service desks;

- through the Qiwi terminal (Qiwi).

Payment by Velcom by bank card

The safest and fastest way to transfer payment to the Velcom operator account at any tariff is with a Visa or MasterCard through its official portal. How to pay the balance of a Velcom number with a bank card:

- Go to the company website oplata.velcom.by.

- Select the region in which the subscriber lives.

- Provide personal information about the payer.

- Select the “Manage payments” item.

- Select “Pay for goods and .

- Enter the phone number to be paid.

- Enter the transfer size.

- Click "Next".

- Indicate all the details of the bank card from which the funds will be debited (the details can be saved on the portal for further payments).

- Click "Payment".

- Confirm the operation with the password from the SMS message.

- The money has been credited to your mobile balance.

Important! Paying for communications by card can be even easier if the subscriber uses the Personal Account on the Velcom website. Here, first indicate the phone number as a login, and then the password received upon request by SMS message.

Next, all payment information is written in your Personal Account. To make it convenient to top up your account from a bank card on a regular basis, you can leave the transaction in the templates and make all subsequent payments in one action.

How to connect SMS banking to Belarusbank

Electronic devices called information kiosks have been installed for clients of JSC JSB Belarusbank. Using them, you can carry out card transactions, receive information or reference information.

Using the information kiosk, it is possible to carry out the procedure for registering and activating the SMS banking service. You must have a mobile gadget with a SIM card from.

- Select the “Service Connection” button on the touch screen;

- Insert the plastic card into the card reader;

- Enter the PIN code from the device’s keypad and click – “Confirm”; The next action will be to select – “SMS banking”, “Registration”;

- It is recommended to read the Service Agreement and touch the “Next” button;

- Select the name of the mobile communication provider whose number will be used for banking;

- Enter the numbers corresponding to your mobile phone number and click “Next”;

- Now you need to send an SMS message from the number entered during registration, with the text – “1”, to a special number – 611. Click – “Next”.

After all these operations, the information kiosk will issue a receipt containing an access password for using the service - SMS banking. This password will be duplicated by SMS notification to your gadget.

- On the touch screen of the information kiosk, touch the “Connect services” button and insert the plastic;

- Using the built-in keyboard, enter the PIN code and click “Confirm”;

- Having selected the item – “SMS banking”, you need to click – “Cancel registration”;

- Please enter your mobile number. the phone from which you want to unregister from the service, and – “Next”;

- Don't forget to take out your bank card!

Internet banking is a very convenient system for clients to manage their accounts remotely, at any time of the day, from anywhere in the world where there is an Internet connection.

If you are registered in the Internet banking system, then the question of how to connect Belarusbank SMS banking via the Internet can be easily resolved.

If you have expressed a desire to no longer use the SMS banking service, you can disable it in your personal account on the “Internet banking” website by going to the “Accounts with card” section, then “Additional services”, “SMS banking”, “Cancellation of registration” . Next, follow the system prompts.

To connect SMS banking from your phone, you must first install a program for mobile gadgets - M-Belarusbank. This application was specially developed by JSC “ASB Belarusbank” for mobile gadgets with Android, Apple, and Windows Phone OS.

But still, you can’t do without a trip to the nearest information kiosk. You will need a receipt containing the authorization password entered when entering SMS banking, issued by the machine.

Installing the application takes minimal time. You will need to come up with and specify a password for authorization in the application (entered each time you start the program), select the type of communication (Internet or SMS), and enter the phone number of the operator to which the card was “linked”.

- We come up with a name for it and enter it in the appropriate field;

- Below we enter the SMS banking password from the check received at the information kiosk;

- Next, you have to choose one of the packages that are currently in effect.

Note: funds for the cost of the selected package are withdrawn from the card account at the bank, and all costs associated with sending SMS messages are withdrawn from the subscriber's account of the mobile operator. Payment for the Internet is made according to the current tariffs of the provider you choose.

How to activate the SMS banking service was stated above. But to fully use this tool, you need to know the list of commands that are entered in the body of the message and sent to number 611.

- When typing commands, only Latin alphabetic characters are allowed;

- When entering a password, use lowercase or uppercase alphabetic characters;

- All bank client data is entered without using spaces or separators;

- When entering an amount, when dividing the whole from the fractional part, you can use a dot;

- Message elements, such as password or transaction type, amount, etc., can only be separated using a space.

SMS banking is a service provided by JSC ASB Belarusbank. It is available to all bank clients who have received a payment card. Registration of a service is simple and does not take much time. But after registration, a person receives a lot of useful functions for managing his card accounts without leaving home.

Transfer money from Velcom to Velcom

Velcom is the largest mobile operator in Belarus, providing its subscribers with many useful services and options. Thanks to this, they can use SIM cards not only for calls or access to the Internet: people have the opportunity to pay another person’s bills from their phone. This is convenient when you need to top up your balance urgently.

Not so long ago, one of the easiest options for transferring money between Velcom accounts was a personal visit to the company’s office. When coming here, you should have your passport and the number of the person to whom the payment is transferred. Previously, this method was the only one, but today it is possible to carry out this procedure without leaving your own home.

Any Belarusian resident can easily transfer funds to another person’s number through a payment service called iPay:

- Send an SMS with any content to number 5533.

- Receive the code and enter it on the iPay portal when registering on it.

- Click "Login".

The sent code cannot be used several times, so whenever there is a need to make a payment from Velcom to Velcom, you will need to receive it again.

Transferring funds between Velcom accounts can also be carried out in this way: send an SMS message with the text “service code recipient phone number transfer amount” to number 553. Service code – 101. All information contained in the SMS is indicated separated by a space and without extraneous characters.

How to choose the right welded mesh fence

When purchasing a fence made of welded mesh, you should pay attention to many nuances, one of which is the type of structure covering. Modern manufacturers use non-galvanized and galvanized welded mesh in rolls for fences

- home

For panel or sectional mesh products, PPL and PVC coatings are used.

PPL coating or powder paint without the use of liquid solvents is characterized by reliable and high-quality adhesion to metal thanks to a special application and baking technology. Powder paint is resistant to mechanical stress and other negative environmental factors. The disadvantage of the composition in question is its low elasticity, which makes it impossible to use powder dyes to coat products in rolls. That is why powder paint is only suitable for processing finished sections.

It is worth noting that the use of powder technology allows the sectional fence to be painted in any shade from the RAL catalog.

Welded mesh for fences coated with PVC is characterized by fewer positive aspects. Despite the fact that polymer coating is more elastic than powder coating, its resistance to external influences definitely leaves much to be desired. In addition, due to the specific nature of coating, the cost of polymer products is quite high.

In order to buy a suitable welded mesh fence, you must first decide on the main purpose of its installation.

Here are some recommendations for choosing mesh fencing structures:

- For fencing private property, it is better to use a mesh 1.25–2.05 m high with a wire thickness of 4–4.5 mm.

- The best option for fencing industrial areas is welded mesh with a height of 2.05 to 2.25 m and a rod thickness of 4.5–5.5 mm.

- It is better to fence children's playgrounds and public areas with a mesh 1.25–2.25 m high and a wire thickness of 4–5.5 mm.

- The smaller the mesh size and the thicker the wire, the more stable and durable the fence.

One of the most significant parameters when choosing a fence is its strength, which directly depends on the quality of welding. You can verify the high quality of welding work by unrolling the roll of mesh and forcefully pulling the fabric in different directions.

If you see that all the rods are securely connected to each other and do not lag behind each other, you can buy the fence. Don’t forget to also ask the consultants exactly how the zinc coating was applied. It is best to buy welded galvanized mesh for the fence, the coating of which was applied using the hot method.

As for the electrogalvanic method, as practice shows, it does not provide the proper level of protection for the mesh material. The coating obtained by this method is rather decorative

When purchasing a fence made of welded mesh with a polymer coating, you need to pay due attention to the quality of the surface. There should be no defects on it

The presence of chips and cracks should be a definite reason to refuse the purchase, since any damage may lead to a violation of the declared characteristics.

Another important nuance is that the cells are even and identical, the dimensions of which fully correspond to the declared parameters. Uneven or different sized links are also a reason to continue the search for a better quality product.

And don’t forget to check the technical documentation before purchasing a fence: all the characteristics in it must correspond to reality. Experts recommend buying a mesh that has a quality certificate, since the presence of a passport does not guarantee that the product will be manufactured in accordance with all existing norms and standards.

Payment via the Internet by card

Another convenient way to pay for a Velcom SIM card is through Internet banking from a payment card. How to deposit money on Velcom online:

- Log in and enter the Personal Internet Banking Account of the banking organization whose client is the payer.

- Select the payment type – “Mobile communications”, and the operator – Velcom.

- Write a phone number.

- Specify the size of the transfer.

- If the subscriber has several payment cards, you must enter the details of the one from which the funds will be debited.

- Confirm that the information provided is correct.

- Confirm the transaction with the code from the message received on your cell phone.

- Balance replenishment is completed.

In order to make payments with maximum convenience in the future, it is recommended to create an appropriate template to reduce the duration of the process of paying for communications via the Internet using a card.

Official site

- The subscriber needs to go to the page – https://www.velcom.by/epay.

- We select the type of paid service: mobile communications, Home Internet and TV, etc.

- Enter the plastic card numbers and email.

- Enter the payment details: DM or mobile phone numbers.

- Carefully enter the remaining card details.

- We confirm the operation with the code that will be sent via SMS.

There you can also go to your personal account and view information about the available replenishment amount.

Other payment options

There are other options for how to pay a Welkom balance, less popular, but just as convenient as those described above.

iPay

Using this payment amount, you can not only transfer money from Velcom to Velcom, but also top up your phone balance yourself.

Step-by-step payment instructions:

- Log in to the iPay system by sending a standard SMS with any text to 5533.

- In your Personal Account, select mobile phone top-up. Here you can also track the history of payment transactions.

- Proceed according to the instructions provided by the service.

SMS banking

To pay a bill using this method, it is necessary that SMS banking from the bank where he is serviced is connected to the payer’s phone.

There is nothing easier than topping up your mobile account using USSD commands sent to the service number of a banking organization whose client is a Velcom subscriber.

How to proceed:

- Send a message with the payment command, transfer amount and access code to the service number.

- Receive a notification that the payment was successful.

Restrictions

When activating the option, you should remember that there are certain restrictions. Basic:

- a subscriber who has been a Velcom client for more than one month can activate the service;

- the option is valid for only seven days, after which you need to top up your balance in order to use all the operator’s services again;

- the user is limited by the available limits - from 1 to 3 rubles, they are set depending on his communication expenses for one payment period (month);

- legal entities cannot use this service;

- the option is not available on tariff plans other than those indicated;

- there should be no outstanding debts on the subscriber account;

- If the SIM card is financially blocked, you cannot connect the “Available Balance”.

Subject to the mentioned conditions and restrictions, the subscriber can use the option without any problems and not pay for communication all 7 days before its expiration. This is especially convenient if it is not possible to top up your account immediately, but the operator’s services are required continuously.

"Mobile Bank"

One of the most affordable options, which requires the payer to activate the “Mobile Bank” option. As a rule, you can activate it for free and at any time, and “Mobile Bank” will become paid after one or two months of use (the cost is determined on the portal of the financial institution). This service allows you to perform any operations around the clock, including replenishing your or someone else’s Velcom balance. The main thing is to have a cell phone with an application installed on it from the bank serving the subscriber, and access to the Internet.

How to top up your balance:

- Register and log in.

- Specify the type of payment – “Mobile communications” -> Velcom.

- Indicate the phone number for which you want to pay.

- Enter the transfer amount.

- Confirm the transaction.

For subscribers of the Velcom operator, replenishing a mobile phone account is possible in many ways. Each of the payment procedures is elementary and simple, moreover, it can be made very easy by adding the completed payment to the templates.

The only important rule for those who pay for communications remotely is to carefully indicate payment details without making mistakes. Banking organizations will not be able to return funds sent to the wrong number, and it is not always possible to do this through an operator.

Many mobile operators provide a service that allows subscribers to transfer money to each other from their phone accounts. Relatively recently, it became possible to transfer money from one Velcom account to another. This article will discuss methods by using which you don’t have to worry that the money sent will not reach the desired recipient.

Story

Logo of IP "MCS" before rebranding in 2008

The company began commercial activities on April 16, 1999 under the name JV Mobile Digital Communications LLC and became the first GSM cellular operator in Belarus (the first cellular operator was the NMT operator BelCel).

Since November 2007, the company has been part of the A1 Telekom Austria group. In May 2008, the company rebranded, changing the logo and name to UE Velcom.

In May 2009, the company signed an exclusive agreement with BelSel JV LLC (Diallog trademark) to provide broadband Internet access services based on CDMA2000 technology (EV-DO Rev.A).

On March 17, 2010, the company announced the start of commercial operation of the 3G network.

At the end of 2021, velcom acquired one of the largest providers in Minsk, Atlant Telecom.

In August 2021, the purchase of the third major provider of the Republic, Gomel Garant, was announced.

From December 1, 2021, velcom united the fissile Internet brands Atlant Telecom, Garant and Home Network (Infolan) under the single velcom brand.

In December 2021, the first NB-IoT network in Belarus for the Internet of Things was launched in Misnka.

From February 16, 2021, part of the subscribers of the Minsk provider “Business Network”, as part of joining velcom, was transferred to service by velcom.

From March 1, 2021, all fixed Internet subscribers were transferred to a single velcom TV platform under the VOKA brand.

In April 2021, the purchase of the Vitebsk provider Garant was announced.

How to make a translation: two ways

Not so long ago, it was possible to transfer money between the balances of numbers serviced by the Welk operator only when visiting the company’s office. Today this method also works, and in order to use it, you need to come to the office with a passport and details for the transfer.

However, there is a very easy option - transfer money through the phone after connecting the phone to the iPay service.

Important!

This method is suitable for those who want to perform all operations remotely using SMS messages. The main condition is that the balance of the sender’s phone must be topped up with an amount sufficient to complete the transfer.

Registering and linking your phone in iPay

A resident of Belarus who is a Velcom subscriber can connect to the iPay service to transfer funds to other numbers.

The connection is made as follows:

- You need to send an SMS message to number 5533 (its content does not matter).

- The system will send a one-time code to the phone, using which the user can log in to the iPay.by website. Also, the subscriber's telephone number must be entered into the authorization form.

- Registration in the system is automatic, and all further logins require entering a new password sent via SMS.

After this, you can transfer funds between Velcom numbers. It doesn’t even require authorization on the site - transfers are made by sending SMS. The main thing is the correct content of these messages.

Transfer by phone: sending SMS

It is possible to send money to a Welkom phone number in Belarus by sending a message to service number 533. For this, the following format is used: service code*phone number*size of the item.

The first parameter in all cases is 101, and it is indicated unchanged. The second is the recipient's phone number. The size of the transfer is written by the sender independently. Spaces are preserved when entering data.

Transfer conditions and commission

The service is not provided free of charge - a commission fee of 3.5% of the entire transfer is charged.

The commission is additionally debited from the sender's phone account. Sending a message also requires a fee, and here you need to find out the cost at your own rate.

The operation will be completed successfully if the amount of at least 0.1 Belarusian rubles remains on the phone. It is impossible to receive services with a zero balance.

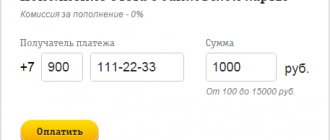

E-Pay

NOTE! Only personalized cards of MasterCard and Visa payment systems are accepted.

- We go to the payment page – https://e-pay.by/velcom.

- Next, select the type of payment details: “payment to phone number” or “Payment by personal account.” The contract numbers are located in the contract or in the receipt for payment for services. This service does not check the correctness of the entered number, so be careful when filling it out.

- Enter the props. Next, indicate the number of replenishments in Belarusian rubles (not less than 0.5 and not more than 400 rubles).

- Click “Start replenishment”.

- We indicate the card number from which the funds transaction will be made.

- Next, wait until the page loads.

- Next, enter the remaining card details: expiration date, owner’s name and CV verification code.

- Afterwards, a code will be sent via SMS to the number to which your bank card is linked. Enter it in the box on the website and confirm the transfer.

Possible problems and their solutions

By strictly following the step-by-step instructions, it is unlikely that you will encounter any problems when transferring money from Welkom to Welkom in Belarus.

The main thing is to correctly enter all the necessary details so that the funds go where they should.

Canceling an operation is not an easy procedure; contacting the payment service support service or directly to the operator does not always bring the desired results.

If absolutely all actions were performed correctly, but the money was not transferred via phone, it is possible that the sender’s balance simply does not have the required amount. You should always take into account the fee charged for the service provided and the cost of sending the message. If there is a shortage of funds, there are two options: replenish the balance or transfer a smaller amount. In this case, the procedure should complete successfully.

INTEREST-FREE payment for services*: Internet, Cable TV, Telephony in the office daily from 09:00 to 21:00

*Subscription payments for the Internet by bank card in our office are accepted daily from 09:00 strictly until 20:00.

Office address: Lytkarino, st. Lenina, 21.

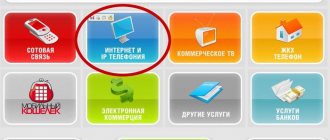

Payment via QIWI terminals

Dear subscribers!

From 06/01/2014 The payment procedure in QIWI terminals has been changed. Now, to pay, you will need to find the operator WELLCOM-L LLC through a search on the terminal, indicate the payer’s details (full name and ID) and deposit cash, taking into account the terminal commission of 3.5% + 15 rubles. over payment.

Draw your attention to!

- The period for crediting funds to your personal account will be from 3 to 7 days.

- The commission is deducted from the total payment amount

Instructions for payment via QIWI terminals

click on image to enlarge

Payment via bank

To pay via bank*

1. PJSC "Sberbank", Moscow

Bank details of WELLCOM-L LLC as of 09/05/2016

:

LLC "WELLCOM-L" INN/KPP 5026115654/502701001 Current account 40702810440000004090 BANK PJSC "Sberbank Moscow" Correspondent account 30101810400000000225 BIC 044525225

What difficulties may arise

When a person follows the instructions, he will not face any problems while transferring money. The main thing is to enter the details correctly so that the money goes to the right subscriber. After all, it will be extremely difficult to cancel the procedure if it has already happened. And contacting a payment system or operator does not always yield results.

If everything was done correctly, but the money is not transferred, then there are probably not enough funds in the account. Because you additionally need to take into account the commission that is charged for the procedure and the cost of sending SMS. If you don’t have enough money, then you can either send less money or top up your account. Then everything should go well, and the recipient's balance will quickly increase.