The MTS personal account is an excellent way of self-service for existing subscribers. With its help, you can independently perform such operations as changing the tariff plan, connecting the service you are interested in and disabling unnecessary functions, ordering your favorite songs instead of long beeps, receiving detailed statements on account movements, clarifying calls made, and much more. At the same time, subscribers do not need the help of managers and their advice. You can access your account from any device that supports the required format.

A big plus is the ability to order printouts of detailed calls for a certain period, which allows you to track the movement of funds in your personal account and understand what services the money is debited for. To prevent information from falling into the hands of criminals, do not give your personal account login information to anyone.

Your personal account also

- number blocking;

- ordering financial papers for legal entities;

- detailed payment history;

- opportunities for free SMS and MMS communication;

- access to a bonus account and spending accrued points;

- management of “favorite numbers”

- establishing parental control;

- activation of the “Promised payment”.

As you can see, the number of functions available to the user is quite large, which allows you to promptly resolve the issue without calling or communicating with a consultant.

How to block Sberbank Online personal account

The use of online services in managing your own funds is an indispensable function in the life of a modern person. However, situations often occur when it is necessary to block it.

Why do you need to block your personal account?

Blocking access to the service is relevant in the following situations:

- termination of financial relations with the bank;

- expiration of loan and deposit agreements;

- full settlement between the parties;

- reluctance to pay for mobile banking services, especially during periods when financial transactions are not carried out;

- lack of funds in the account.

How to disable

There are several ways to close your Sberbank Online personal account:

- Issue a refusal through the operator by calling one of the bank’s hotline numbers.

- Personally visit bank branches to fill out an application for the option to block the online service.

- Take advantage of the automatic disabling of the ability to use the option as a result of the lack of funds in the account necessary to write off payment for services.

To understand how to block Sberbank Online, a personal account in which you can carry out all the necessary operations, you need to follow the service prompts. In this case, you can use the option to temporarily disable it.

How to remove Sberbank Online through a hotline operator

Removing access to the online service with the help of an operator is not always possible, because some types of cards cannot be disconnected from the service package over the telephone. If the banking product supports such a function, then when you call (hotline number: 8-800-555-55-50) you need to be prepared to provide information:

- card number;

- passport details;

- contract number;

- a code word provided to identify the client when communicating with him over the telephone.

The decontamination service after acceptance of the application is implemented within 3 working days.

Deleting a personal Internet banking account in a bank branch

A personal visit to the office of a financial institution is the most reliable and correct way to terminate the relationship between the parties, which entailed disconnection from the service. It is worth noting that you can block your personal account without stopping cooperation with the bank.

To do this you need:

- Visit a bank branch, remembering to take your card and passport with you.

- Complete the application in the form prescribed by the bank.

The service will be blocked within three working days, and a corresponding notification will be sent to the client’s mobile phone.

How to delete your Sberbank Online personal account automatically

In accordance with the terms of banking services, the client’s lack of money in his account is grounds for restricting his access to his personal account. To implement the operation of blocking the account according to this scheme, it is enough to withdraw money before the date when the service fee is written off, leaving an insufficient amount in the account to make the payment.

How to disable Sberbank-online

Users of the Sberbank Online application appreciated its functionality. Of course, if you own Sberbank cards, it’s more convenient to manage your funds through this online bank. But sometimes, for various reasons, it becomes necessary to disable Sberbank online. The article describes how to do this.

It’s worth clarifying right away that we are talking about deleting the application from mobile devices. It is impossible to delete a user’s personal account from the web space. A Sberbank client, having registered in the system and carried out even one operation, becomes a participant in the information system, and his data cannot be destroyed - technically this is not provided for. You can block access to your account data, and logging in will be impossible, even if you know your login and password. If you want to reactivate your personal account, the owner must write a statement and the block will be removed by specialists from the bank’s technical service.

How to disable Sberbank-online

If you lose your phone or tablet, or if you suspect unauthorized access to your personal account, it can be blocked. There are two ways to do this:

- Urgent blocking via technical support. By calling 8-800-555-55-50 and waiting for the operator to respond, you need to provide your passport details and card number.

- Blocking through a Sberbank branch. You need to contact an employee of the operations department, having your passport with you. After receiving and processing the application, access to your personal account will be blocked. The procedure takes a few minutes.

How to remove an application from mobile devices

From Android gadgets, the Sberbank-Online application is removed in the same way as any other.

The procedure is as follows:

- On the desktop, find the “Settings” shortcut and go to the section;

- Select the "Applications" option

- Find the “Sberbank” application in the list and mark it with a tick;

- Click the “Delete” button

- Confirm deletion by clicking “Ok”

When deleting an application from iOS devices, the steps are simpler:

Find the “Sberbank” shortcut on the desktop and click;

- Hold until a cross appears in the corner of the label;

- Click on the cross, then click “Delete”. The program and shortcut will be deleted.

The Sberbank Online application installed on any mobile device may be subject to a virus attack. If this has already happened, then you need to use a protection system and remove malicious threats. To prevent infection, it is enough to periodically update the Anti-Virus systems on your gadgets.

Internet banking and mobile application programs can be restored on devices at the request of the owner. To activate a blocked personal account in Sberbank Online, you must submit an application to a bank branch. Installing mobile applications on a new phone or tablet is done in the usual way; details are here.

Is it possible to delete an account in Sberbank online

The desire to delete your Sberbank online personal account may be due to various reasons, however, most often such manipulations are resorted to when refusing the services of a given financial organization. Please remember that it is impossible to delete such an account yourself. For this purpose, the bank client can use the following methods:

- refuse Internet banking services by contacting the financial institution using the hotline number;

- apply for disconnection when visiting a branch of the institution in person;

- deactivate the mobile application.

Sberbank online is a popular service

In addition, the user can achieve automatic blocking of access, but this will not allow the system user’s personal account to be permanently deleted.

Removal via a call to the call center operator

If you want to close your personal account remotely, the best solution seems to be to call the hotline of this financial institution. To do this, you will need to call the toll-free number 88005555550 and express a desire to delete your account.

The algorithm of actions that will need to be performed to deactivate will be as follows:

- Wait for a response from a specialist and notify him of the need to delete the system user account.

- Provide information that allows you to identify the user - passport data, the code word specified in the agreement when opening a card or registering other products.

- Wait until all necessary operations are completed.

It is important to remember that deleting an account using this method is not possible in all cases. Some cards do not support this feature, which is why it is advisable to give preference to other methods. If you want to permanently delete your Sberbank Online service account, it is recommended to also disable the Mobile Bank option, which is responsible for remotely performing transactions via SMS.

After all, if fraudsters gain access to the client’s phone, they will be able to seamlessly transfer funds through such a service.

Visit to a bank branch

When figuring out how to remove yourself from Sberbank Online, it is advisable to study the simplest and most obvious method - visiting a branch of a financial organization. This method seems to be the most common among users, as it allows you to guarantee that you can disable an online banking service account for any products of a given financial institution.

Moreover, after successfully disabling the service, the user will be able to cooperate with the bank without any restrictions. In order to block a personal account in Internet banking using this method, the user will need to follow the simplest instructions:

- Visit the branch and wait your turn.

- Request an application form from the employee to refuse to use Sberbank Online.

- Fill out an application.

- Present a passport of a citizen of the Russian Federation to confirm your identity.

- Submit a completed application.

3 days after the client’s application was accepted by the bank’s specialists, the account will cease to exist, which will prevent fraudsters from gaining access to it.

When using this method, it is extremely important to contact exactly the bank branch in which the product attached to your personal account was previously opened.

The hotline operator will help you delete your personal account

Automatic removal

It is not always necessary for a user to take any action in order for access to Internet banking to be blocked. After all, the terms of banking services imply that the organization’s services are provided to the client exclusively on a paid basis. In this regard, the lack of funds on the balance becomes a reason for automatic blocking of the account.

It will not be possible to delete a page in the system using this method, but it is ideal for blocking access. To do this, you just need to transfer the existing funds to another account or cash them out before regular debits occur. In addition, there is an alternative method for those users who used a mobile application to authorize in the service.

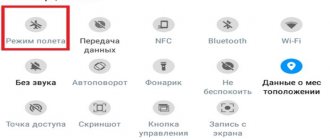

It involves the following manipulations:

- Go to the “Settings” category in the smartphone menu.

- Open the “Applications” section and select the desired item.

- Click on the “Delete” button and wait for the procedure to complete.

This method will allow you to delete the application, which will reduce the likelihood of fraudsters gaining access to your account. However, like the previous method, it will not allow the client to permanently delete the account.

Thus, deleting a personal account in the Sberbank Online system can be done using various methods - remote, involving a call to a call center, and traditional, involving a personal visit to a branch. In this case, it is possible to automatically block access, but it will not allow you to permanently delete the account.

How to delete Sberbank Online through your personal account

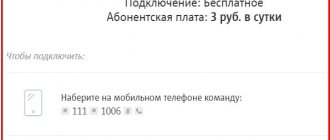

- Connection

- How to disable the service?

has been operating for individuals since 2009.

Provides comfortable remote management of a Sberbank card online (via an Internet channel). Currently it includes the following options:

- work through your Personal Account with loans, deposits and accounts opened at a bank or at an ATM (replenishment, repayment, blocking, extension, etc.);

- registration and deactivation of various services and additional services (enable/disable automatic payment for telephone, full package of “Mobile Bank” options, etc.);

- notification to the specified phone number about Sberbank services and products 24/7;

- purchasing products and paying for services;

- money transfers between accounts of individuals and legal entities.

Login to your personal profile “Sberbank Online” is carried out on the website online.sberbank.ru or in the mobile application after specifying your login and password.

Connection

Access to the service is provided to all owners of valid Sberbank cards (including credit and debit cards).

Activation can be done in the following ways:

- Get credentials (login and password) for your personal profile using your card number on the website.

- Call the bank's customer service. Contact an employee with a request to connect the online service and provide him with personal data and card details.

- Request a login and password for your account in the banking device “User ID” (the machine will print the authorization data on the payment receipt).

Upon completion of registration, all Internet banking options at Sberbank will be available to you.

How to disable the service?

Bank clients have the right to leave the online service at any time that suits them. However, you cannot delete your profile remotely.

To disable Sberbank online, do the following:

- Visit a bank branch.

- Please inform the employee at the cash desk that you wish to deactivate the service.

- Complete the application given to you.

After submitting the deactivation document, you will no longer be able to log in to your profile on the offsite using your login.

If necessary, access to the online service can be restored by requesting new authorization data.

Enjoy your comfortable use of Internet banking!

If you found the article useful, don’t forget to like it!

Installation and registration in “My MTS”

To install, configure and start using the My MTS application you do not need to be an advanced user. This process is not difficult and is accessible to everyone. However, just in case, we have prepared a step-by-step guide.

First of all, you need to install the application on your smartphone or tablet. Depending on your phone model, you need to look for the application in the AppStore, Google Play or Windows Store. Just enter “My MTS” into the search line and download the application. If the method of downloading the application described above does not suit you for any reason, you can order a link to download the application through the MTS website.

After downloading the application, you need to immediately install and launch it. An Internet connection is required for the application to work. The My MTS application works not only via the mobile Internet, but also via Wi-Fi. When starting for the first time, it is advisable to connect via mobile Internet to simplify the registration procedure.

As for authorization, everything is even simpler here than in your MTS personal account. That is, you don’t even have to order a password; logging into the self-service system will happen automatically. The main thing is that the phone has an MTS SIM card installed. If automatic authorization does not occur, or you need to access management of a SIM card that is not installed in the phone, you will have to log in manually. There is nothing complicated here either. Enter the number you want to access in the appropriate field and wait for the code that will be sent via SMS to the specified number. Enter the received code in the appropriate field and log in. For security and convenience, you can set a strong password for authorization in “My MTS”.

- Important

- The application is free, but the traffic consumed when using it is paid for. Paying for traffic directly depends on your tariff.

Managing the My MTS application

After completing all the steps described above, you will gain access to the capabilities of the self-service system.

We have already reviewed the functionality of the My MTS application and, as you have noticed, there are more than enough opportunities for the subscriber. Managing these same features is very simple. The following important sections can be distinguished in the “My MTS” application:

- Check;

- Rates;

- Internet;

- Services;

- MTS Bonus;

- Roaming;

- Support.

You can read each section yourself. In principle, questions regarding the purpose and application of each section should not arise. In addition, MTS made sure that the application is convenient for all clients, and therefore your every action will be accompanied by system prompts. If this is not enough for you, use our explanation. We briefly described the purpose of each section.

Sections of the My MTS application and their purpose:

- My MTS. When you first log into the application, you will be taken to this section. Here you can get information about the status of your personal account, tariff plan, balance of service packages, etc. The information presented in this section may vary slightly depending on your tariff. Usually the most important information for the subscriber goes here.

- Check. This section allows you to control and manage the status of your personal account. Here you can not only find out about the balance on your balance, but also deposit money into your account in various ways. In addition, through this section it is possible to make account details free of charge. If there is a need to take the promised payment, you can do this through this section.

- Rates. If you have forgotten the terms of your tariff plan or want to choose a new tariff, this section will be useful for you. You can change the tariff on MTS directly through the application without entering any commands.

- Internet. Most tariffs provide for a limited traffic package, which means there is a need to control the rest of the Internet. This section provides information about the remaining traffic. Here you can also look at the options for the Internet and connect the one you need.

- Services. This section is one of the most useful, because it allows you to see what services are connected to the number. Quite often, paid services that are completely useless for the subscriber are connected to the number. Here you can study information about connected services and disable unnecessary ones. Conversely, you can easily connect services that are useful to you. Connecting and disconnecting services is done in two clicks.

- MTS Bonus. The MTS Bonus program allows you to accumulate points and subsequently exchange them for various gifts. This section provides information about points and a catalog of gifts. Points are awarded as part of the MTS Bonus program. You can become a participant in the program through the application.

- Roaming The section is intended for subscribers who are often in national or international roaming. To reduce communication costs while traveling around the country or the world, you need to activate a suitable roaming option in advance. In this section you will find the latest offers and you will be able to activate roaming on MTS.

- Entertainment. The section provides access to the entertainment service from MTS. The operator provides a fairly large selection of entertainment, most of which are paid.

- Applications. In addition to “My MTS”, the operator has many other applications, some of which may be useful to you. This section provides a list of all applications from MTS with their detailed descriptions.

- Support. No matter how hard MTS tries to make its services accessible and understandable, subscribers still have many questions. Unfortunately, getting through to an operator is sometimes very problematic. This section is intended to assist subscribers in resolving various issues. Here you can ask a question and receive an answer by email. You can also request a call back.

Of course, the My MTS application is a very convenient and useful development. With its help, the subscriber can solve many issues, and it does not matter what day and time it is. If you still have not installed “My MTS”, send it immediately. We hope the review was useful to you. If you have any questions, ask them in the comments.

>How to delete your Sberbank Online personal account

Deactivation methods

Today there are not many ways to disable it. It is much easier to connect to remote services. Let's look at everything in order.

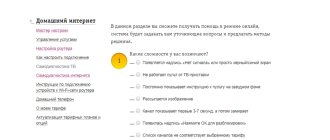

Through the Internet

Currently, in your Sberbank Online personal account you will not be able to find the function to disable your account. Therefore, it is impossible to refuse the possibility of remote servicing at the bank in this way. Representatives of the financial institution do not say what is the reason for the absence of this option and suggest using other methods to deactivate the option.

Can ATMs be used?

Currently, there is no option to disable Sberbank Online via an ATM. The machines only allow you to register a personal account and obtain identification data without the possibility of “reversing”.

At the service office

Visiting the nearest bank branch is another way to close your personal account in the Sberbank Online system. Don't forget to take your passport with you. The operator will print out a special application form that must be filled out and signed.

By phone

In conclusion, let's look at how to disable Sberbank Online on your phone. Currently, various mobile applications are widely popular, allowing you to gain remote access to your bank accounts via smartphones and tablet PCs. Sberbank clients who actively use modern gadgets use a special application for this purpose.

Of course, you can delete the Sberbank Online application from your device, but this step will not allow you to completely disable your account. The mobile application serves only as a tool for accessing the service. When you delete the program, your login and password will remain valid, so they can be used to log into your account from other mobile devices or computers.

If you used the Sberbank Online service, you must have Mobile Bank connected, which allows you to receive one-time confirmation codes. Blocking this service will close your personal account, since the bank will no longer send one-time login passwords. To block Mobile Banking, send an SMS with the text “ZERO” to the short number 900 from the phone number whose number was used when connecting the option. After a few seconds, you will receive a response message with a confirmation code for the blocking procedure. It must be sent to number 900 - and the “problem” will be solved.

>How to disable Sberbank mobile bank: Video