Main types: description and advantages

Beeline card is a convenient means of payment from a mobile operator.

Plastic cards are issued by RNKO Payment Center. The line includes debit and credit options:

- MasterCard Standard;

- MasterCard World;

- MasterCard World Contactless.

These products are further divided into 2 types: registered and unnamed. There are no virtual cards.

Debit

Beeline debit cards are products that combine various financial technologies, banking services and a bonus program. These means of payment are accepted by all merchants and service providers cooperating with MasterCard. You can pay for goods and services in Russia and abroad in regular stores and on the Internet. When making transactions abroad, funds are converted at the Bank of Russia exchange rate.

Main advantages of debit products:

- cashback is provided;

- You can activate the option of calculating interest on the balance.

Credit

Credit cards are means of payment with an attached limit. The maximum approved amount is 300 thousand rubles. Interest-free period - up to 55 days. The loan rate valid the rest of the time is from 28.9% per annum.

Tinkoff considers applications for credit cards.

Cards with a credit limit are not issued to everyone. Applications are reviewed by Tinkoff Bank. He often refuses people with a bad credit history or insufficient income. The exact reason for the negative decision is not communicated to borrowers.

Advantages

3When choosing a Beeline card, you can count on the following opportunities:

- Favorable offers for currency conversion, they are carried out without additional commissions and at the established rate.

- Payment with a card from this operator can be made in any country.

- An expanded bonus program for purchases; savings from it can be used when paying for mobile communications, TV and the Internet.

- Free SMS information and card service.

- Use of credit funds with a grace period.

- Convenient account management through your personal account; there is a simplified version for mobile phones.

Master Card Standard provides for interest accrued on the balance; it is recalculated daily and transferred to the account once a month. The initial interest rate is 7%, the more funds remain on the plastic, the higher the percentage.

Tariffs and conditions of receipt

All Beeline debit and credit products are subject to several general conditions:

- annual maintenance - 0 rub.;

- cashback - up to 10% of the purchase price;

- The monthly limit for bonuses is 3 thousand.

Debit cards can be connected to the service of calculating interest on the balance. Current rates are 2% per annum for amounts from 0 to 500 thousand rubles. and 0.01% per annum for amounts over 500 thousand rubles.

Beeline cards are available to subscribers of any mobile operators. Conditions for obtaining: age 18 years and over and possession of a valid passport. The credit limit can be activated from 20 to 70 years.

Conclusion

Reviews about this banking product are mostly positive. A negative opinion is only among those users who did not comply with the terms of the agreement or used the card without first reading the recommendations of specialists.

Not all subscribers can understand the bonus program. If you have any questions, please contact the call center for advice. Most users claim that a card from Beeline is much more profitable than bank plastic from VTB or Sberbank.

Bonus program: features

The bonus program is designed for individuals residing in Russia (with the exception of the Republic of Crimea and the city of Sevastopol) and having a MasterCard World card.

The bonus program is designed for persons with a MasterCard World card.

The promotion provides a minimum cashback of 1%. It is credited after each purchase made using a Beeline debit or credit card. The maximum bonus is 10%. It can only be obtained in your favorite categories. They are connected in the Internet bank and application for 31 days in the form of packages.

Table. Packages available for members of the bonus program

| Package name | Incoming categories | Cashback amount | Package cost, rub. | |

| basic | with discount | |||

| "Urban" | Supermarkets | 5% | 699 | 399 |

| Fast food | ||||

| Car sharing | ||||

| "On vacation" | Toll roads | 10% | 749 | 449 |

| gas station | 5% | |||

| Parking | ||||

| "Children's" | Office | 10% | 549 | 249 |

| Baby clothes | 5% | |||

| Toys | ||||

Thanks to bonuses, you can get a discount of up to 90% on Beeline communication services. Points are also allowed to pay up to 99.99% of the cost of goods sold in the offices of the mobile operator. If you have a large number of bonuses, you can buy a phone, smartphone or any accessory for a tiny amount. Write-off rate: 1 point = 1 rub.

Accumulated bonuses may be cancelled. This happens if the participant of the promotion has not made a single transaction within 6 months that leads to the accrual of cashback.

How to order and receive a “100 days” credit card?

First you need to fill out the form on the Beeline promotional website beel.ink/alfa9d below. After approval, you can pick up the card at any Beeline store in the city you specified. The card is unnamed, non-embossed, the number is printed on the back. But what difference does it make, the main thing is that there is free cash withdrawal and an interest-free period of 100 days. In my case:

- in the morning - I sent an application, indicated that according to 2 documents I wanted 100,000 rubles (this was the maximum possible limit at that time, spring 2020)

- in the evening of the same day until 19:00 an incoming call from the number +495-974-2515 is Alfa Bank. Dictate your passport details again, confirm the application and its parameters, inform about further actions, and remind you that you need to take a second document in addition to your passport.

- 19:54 - I received an SMS confirming that the card can be obtained at any Beeline store

- The next morning I went and received a card, it took about 15-20 minutes.

Receiving a card at a Beeline salon

The procedure in the salon is a little tedious, but no more difficult than receiving a regular “100 days without interest” credit card at a bank office. The main feature is that there are no imposed insurances.

The director of the salon came up, took my passport, a second document (compulsory medical insurance policy), took a photo of me with a camera, entered all the information and sent it to the bank. After some time, I received an SMS on my phone number with a link to sign the contract (I wonder, if I only had a push-button phone, what would I do next?). I followed the link and saw the approved conditions, the main thing here is the size of the credit limit of 100,000 rubles.

Further on the button there was another screen where I had to agree and “sign” the agreement. To do this, they first sent me an SMS with a password to log in, and then another SMS with a password to sign a credit card agreement.

Then I was transferred to the Alfa Bank application, which I had installed in advance (remaining from the previously closed “100 days without interest” card), and a window opened to activate the card and set a PIN code. The last recommendation was to complete the activation of the card by putting it in an Alpha ATM and asking for the balance (it’s free). At the same time, the contactless module should work, which I do not need. I just went to the nearest VTB and withdrew the first 50,000, April. In May it will be possible to withdraw another 50.

Personal Area

To monitor the status of the account and the need to make payments, the card has a personal account. As you already understand, this is an application from Alfa Bank, not Beeline. After withdrawing cash it looks like this:

Personal account with Beeline card 100 days

Promotions and discounts from partners

Beeline regularly enters into partnership agreements, which provide lucrative offers for cardholders.

Promotions you can take part in:

- Obtaining free access to the Amediateka service. The offer can be taken advantage of by persons who have issued a non-named Beeline MasterCard World card. All participants are provided with a promotional code for a subscription to the service for 0 rubles. It is valid for 30 days. After the expiration of the term, a subscription fee of 599 rubles begins to be charged. per month.

- Littres.ru - bonuses for purchasing electronic and audio books. Points are added to the card. To receive them, you need to register a 13-digit MasterCard World card number on the Litres.ru website in your personal profile. The amount of charges is 10% of the amount of the first purchase and 5% of the amount of each subsequent purchase. Additional cashback during the month of the user’s birth - 5%.

Cardholders receive free access to Amediateka.

Cashback categories

Since the winter of 2018-2019, the current bonus program of the Beeline payment card consists of 4 packages (and not 9 categories as before). All packages have become paid (!) - 159 rubles per month. At the same time, you can only write off points for purchasing goods at Beeline offices!

"In move":

- Music (5733, 5735) — 10%

- Public transport (4111) — 5%

- Taxi and car sharing (4121) — 3%

"On style":

- Beauty salons (7230) — 10%

- Cosmetics and perfumes (5977) — 5%

- Men's and women's clothing (5691) — 3%

"With kids":

- Cinema (7832) — 10%

- Children's clothing (5641) — 5%

- Fast food (5814) — 3%

"Pleasures":

- Duty Free (5309) — 10%

- Restaurants abroad (5811, 5812, 5813) - 5%

- Gas stations abroad (5172, 5541, 5542,5983) — 3%

In other words, there are few people willing to pay for these packages and then have to struggle with purchasing the bonuses they received.

Methods for obtaining a Beeline MasterCard bank card

Options for designing a debit product:

- Visit to the Beeline office . The card is issued immediately, because it is non-personal. To receive, you only need 1 document - a passport.

- Order in online banking or mobile application . This method can be used by individuals who already have a non-registered means of payment. Remote service services provide for submitting an application for the issuance of a personalized Beeline card with a chip and contactless payment technology. Delivery is carried out by courier to your home or to the nearest Russian Post office.

- Order on the official website bank-beeline.ru.

No special credit card is required. In order for the bank to lend money, you must first receive a Beeline debit payment instrument. The next step is to apply for a credit limit.

You can order a bank card on the website bank-beeline.ru.

The online form for filling out is located on one of the official Beeline websites - credit-beeline.ru. If the limit is approved and activated, the card will automatically become a credit card.

Receiving a personalized card

Having created your personal account on the operator’s website, you can use all its capabilities, including: managing your account, checking its status, and the opportunity to order new cards, including personalized ones. It has a chip that allows you to make contactless payments. The issuance and receipt of this card is free, and delivery of plastic via Russian Post will cost 200 rubles.

Owners of other types of cards can freely exchange their payment cards for a contactless option, all their money and bonuses will be transferred to the new financial product without changes.

The card is activated through a personal account, then a PIN code is obtained.

Look at the same topic: How to choose a Sberbank debit card?

Order and receipt procedure

Ordering a card through the official website of a mobile operator is the most convenient way, since you don’t need to go anywhere. Process for registering a debit payment instrument:

- Go to the website bank-beeline.ru and click on the order link.

- Fill out the sections of the form - personal information, confirmation code, delivery address and passport details.

- Check the information provided and confirm the order. The cost of the delivery service is 300 rubles.

When the courier arrives, he will need to show your passport.

Setting up a limit with borrowed funds:

- Go to the website credit-beeline.ru, indicate your full name, phone number, email address. Consent to the processing of personal data.

- Enter the code from the SMS message to confirm the phone number.

- Indicate the date and place of birth, gender, passport data (series, number, by whom it was issued, date of receipt, department code), registration address, home telephone number, contact person, education, total work experience, employment information, monthly income.

- Fill in the fields “Marital status”, “Number of children under 18”, “Housing conditions”, note the presence of property.

- Come up with a code word. You may need it in the future when contacting the bank.

- Check all the information provided. Particular attention should be paid to the highlighted fields. The information contained in them must correspond to the spelling in the passport, down to punctuation marks and spaces.

- If there are no errors, click on the “Submit Application” button.

The online form is located on the website credit-beeline.ru.

A preliminary decision is communicated 1-2 minutes after sending the questionnaire. If approved, you need to come to the Beeline office with your passport. Specialists will scan the document and in about 30 minutes they will report the final decision of Tinkoff Bank.

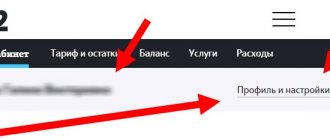

Login to your Beeline personal account (old version)

Login to the main personal account is carried out on the electronic resource https://my.beeline.ru/.

Authorization algorithm for individuals:

- On the website, go to the active line “For individuals”;

- Fill in the user name (phone in the format +7 ХХХХХХХХХХ or your own login) and secret code. Hover over the “Login” banner.

Algorithm for legal entities:

- Go to the section “For legal entities”;

- Print your account and follow the “Login” banner.

Authentication via social networks is provided exclusively to individuals. To do this, in the https://my.beeline.ru/ window, hover over the “F” banner to log in via Facebook (https://www.facebook.com) or “B” for the VKontakte social network (https://vk. com).

Terms of use

After issuing a payment card, the client needs to receive a PIN code. This can be done within 90 days by calling one of the following toll-free numbers:

- 0519 - for Beeline subscribers;

- 8 for subscribers of other mobile operators.

If more than 90 days have passed since the card was issued, you need to call the information center at 8 (800) 700-61-19. During the conversation, you will need to provide the code (a set of letters and numbers) that was received on the phone in the form of an SMS message after receiving the payment instrument.

Recovering your Beeline personal account password

In the program, subscribers can use two protection options:

- Beeline debit card “Mastercard World, Standard and PayPass” - description

- Permanent code . It is set by the registered subscriber independently in the system settings. It is recommended to use a combination of three sets of characters as a permanent password: CAPITAL and small letters, numbers and special characters;

- Temporary code . Automatically sent by the program in a message during the first and subsequent authorizations. It has no “expiration date” and does not require modification.

Recovery is carried out from a PC or smartphone on the authentication page.

- On the page https://identity.beeline.ru/identity, determine the connection method “To mobile or All in one” or “To home”;

- Type your login, hover over the “Get password” banner or use *110*9# + “Call”;

- Receive an SMS and retype the text from it into the appropriate field.

If participants require specialist advice, it is recommended to contact them using the short combination on their smartphone 0611.

Replenishment nuances

The account can be topped up in cash or non-cash. In some cases a fee will apply.

Cash

To top up your card with cash and without commission, the following methods are available:

- Visit to any of Beeline's offices. To perform the operation, you only need a passport. Funds are credited to your account within a few minutes. Sometimes there may be delays.

- Using the terminal of PJSC Moscow Credit Bank. Requires a card. Money is credited instantly.

To replenish the card, use the terminal of the Moscow Credit Bank.

From another card

The Beeline payment instrument can be topped up from a card of any financial institution. To do this, use online banking and a mobile application. No commission is charged when replenishing your account with an amount of 3 thousand rubles or more. In other cases, 50 rubles are debited. for the operation.

Debit

If you are a regular user of plastic, then your best option is a debit card, on the account balance of which interest is charged. Features include:

- Possibility of returning up to 5% on purchases in the form of bonuses;

- Withdrawing money without commission from ATMs;

- Up to six percent per annum on the balance.

The Beeline debit card is based on MasterCard, which allows you to actively use it and choose methods for withdrawing and depositing money into your account.

Deposits and withdrawals

Where to top up a Beeline Mastercard card without commission is possible in this way:

- Through the terminals of PJSC

CREDIT BANK OF MOSCOW; - At the operator's sales office;

- How to top up a bank card? You can use Internet banking or an application from another card (Login to the Beeline card is possible online - read about this in another article).

Commission – 0%. When transferring from a card, there will be no standard commission provided that the amount exceeds 3,000 rubles is sent.

But you can withdraw funds from a Beeline bank card in the following ways:

- At a bank branch:

- At every ATM that accepts MasterCard:

Additionally, you can link your card to contactless payment services and use your mobile phone to pay.

Terms of Service

The terms of service for Beeline Mastercard World are as follows:

- Issue – 300 rubles;

- Maintenance, use of applications, Internet banking and SMS are free;

- Carrying out transactions with currency - at the rate of the Central Bank of the Russian Federation.

Where to get it

To get your Mastercard World Beeline payment card, a few simple manipulations are enough. So, where to get the coveted card:

- Take your passport;

- Make a personal visit to your nearest sales office.

Please note that a non-named card will be activated instantly when you deposit at least 300 rubles into your account. You can make a personalized card and receive a Beeline PayPass card in the online service by exchanging it for a plastic carrier with the possibility of contactless payment.

Cashback

The main feature of plastic is the opportunity to get cashback. There is a monthly check of the balance of money and calculation of interest accrued. Payment is made monthly, accrual occurs according to the following principle:

- One percent from each purchase;

- 5% in selected categories;

- Up to 15% for operator partners.

How to log into Beeline Bank, see another article.

Features of withdrawal of funds

Debit cards are more profitable for cash withdrawals. You can withdraw money from them for free, subject to several conditions.

It is best to leave funds in credit accounts for non-cash payments for purchases and ordering services.

From a card with interest on the balance

The commission for withdrawals from ATMs is 0% if the limits are observed - at least 5 thousand rubles. for 1 operation and no more than 30 thousand rubles. per month. When cashing out less than 5 thousand rubles. 149 rubles are written off. If more than 30 thousand rubles are withdrawn per calendar month, a commission of 2% of the excess amount is charged (at least 199 rubles per transaction).

Commission at ATMs is 0%.

With credit limit

The following terms and conditions apply to credit cards:

- commission 4.9% of the amount and an additional 500 rubles. — when withdrawing borrowed money from ATMs;

- commission 1%, but not less than 100 rubles. - when cashing out your own funds.

Flaws

When deciding to order a payment card from Beeline, you should take into account some of the nuances of its use, which may initially reveal its disadvantages:

- You cannot withdraw funds without a commission; the minimum spend amount is 100 rubles. For the Master Card World card, the operator provided for cash transactions without commissions, but set a limitation: you can withdraw only 5 thousand rubles at a time and no more, and the monthly amount is 20 thousand rubles.

- The payment plastic issued by Beeline is not a banking product; it is prepaid, which is why the funds on it are not insured. If suddenly the RNKO license is revoked, cardholders will not receive insurance.

- Restrictions on setting limits for completed transactions.

See on the same topic: The best debit cards [y] of the year

Cashing methods

The mobile operator provides its customers with the opportunity to choose the most convenient method of withdrawing funds from their card account.

At an ATM

Funds can be withdrawn from your card account at any ATM in the world that has the MasterCard logo. And it doesn’t matter which financial institution owns this or that device.

At a bank branch

It will not be possible to withdraw money from the card at the offices of financial institutions. If necessary, you can use the “Golden Crown” by making a transfer from a means of payment. To receive cash, you need to contact the company's offices. Money is issued using the transfer number and passport.

The translation can be done by the “Golden Crown”.

Registration in your Beeline personal account

Registering in your Beeline personal account is very simple. To do this, you need to create an account on the official website. An account is created in several steps:

- Go to https://beeline.ru/login/.

- There will be a link “How to get a login/password” that you need to follow.

- In the pop-up window, select the desired registration method “To mobile All in one” or “To home”.

In the first option, you should select for which device the account will be created, and then follow the instructions.

In the second option, enter your login or home Internet account. You can also restore your login by clicking on the “I don’t remember my login” link.

Applications and services

Mobile applications and services have been developed to manage the card and obtain additional capabilities. All official tools are secure, as they were created using technologies that ensure maximum data protection and confidentiality.

Apple Pay and Android Pay

To pay for purchases using only a smartphone, you need to download special applications:

- Wallet, which supports Apple Pay for iPhone;

- Google Pay, which is designed for smartphones with Android OS.

You can pay for purchases using Apple Pay.

After installing a suitable application, you need to enter your Beeline card details into it and activate the contactless payment function (if available).

Personal account for Beeline card

Internet banking from Beeline bank.beeline.ru is a convenient tool for managing accounts and finances. The “Personal Account” of the service provides the following functions:

- replenishment of cards;

- making payments and transfers;

- payment for services;

- currency exchange;

- formation of a detailed history of operations;

- viewing the number of accumulated bonuses (if desired, they can be spent directly in the Internet bank).

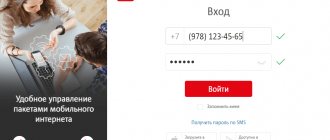

To log into your personal account for the first time, you will need to enter the 13-digit card number and the owner’s phone numbers.

Mobile app

A mobile application has been developed for debit and credit card holders. Its main features:

- view your balance and recent transactions;

- replenishment of a payment product from Visa and MasterCard bank cards;

- payment for various services (mobile communications, Internet, TV, housing and communal services, etc.);

- repayment of loans issued in any Russian banks;

- sending money transfers;

- creation of payment templates.

A mobile application has been developed for cardholders.

The mobile application is available for download in the App Store and Google Play. Beeline subscribers can download the installer using a short command - *407# for Android or *408# for iOS.

SMS service

The Beeline operator offers an SMS notification service to all cardholders. Its cost is 49 rubles. per month. When the service is activated, your phone receives messages with information about all transactions and actions.

The SMS service also includes a free and automatically activated option to ensure the security of online payments.

Every time you pay for goods and services on websites or make transfers, SMS messages with one-time passwords are sent to your phone to confirm the completion of transactions.

Additionally, the mobile operator has provided an SMS informer, with which you can obtain the necessary information on the card at any time by sending a message to the short number 6119.

Request texts:

- to find out how much is in the account - “Balance (last 4 digits of the card number)”;

- to block an account - “Block (last 4 digits of the payment product number)”;

- to get a list of recent transactions - “Extract (last 4 digits of card number)”.

Internet bank "Beeline"

With the help of Internet banking, people will be able to:

- have full access to your balance at any time of the day;

- control expenses by reviewing information about all transfers and payments;

- create templates that can be used when paying for goods or services of a mobile operator;

- fully manage available bonuses.

This service is available to all subscribers. Use is free of charge.

Mobile app

The application allows you to use all the features of Internet banking. It is available on Android and IOS devices. With its help, you can manage your card, find out your balance, or connect additional services.

Negative aspects of using a payment card

The main disadvantages of cards:

- The credit limit is activated for 500 rubles. The amount is written off once upon the first payment with borrowed funds.

- The bank receives information about the transfer of funds within 3 business days. For this reason, credit card holders are advised to make their monthly payment in advance.

- The service of calculating interest on the balance is paid. Commission - 99 rub. per month.

Another negative side is that cards are issued for a fee. The commission fee is 300 rubles.