One of the most important and difficult issues when concluding an agreement for the provision of services or the purchase of goods is the choice of a payment system. Modern legislation offers two main options: prepaid and postpaid system. Read more about them in the article.

Each method has its own disadvantages and advantages, and often making the right choice in favor of one or another option is not easy. In most cases, any system of choice can be used, postpayment and prepayment, the difference lies only in the financial readiness of the customer and the contractor.

Prepayment under an agreement for the provision of services to budgetary organizations under 44-FZ

Federal Law 44-FZ provides for the possibility of using a prepaid payment system. According to the law, the customer is obliged to include in the terms of the contract a clause on the provision or non-provision of an advance payment, as well as indicate its exact amount, terms and method of payment. It is not permitted to include a clause indicating an inaccurate amount of the advance payment.

In most cases, prepayment under 44-FZ ranges from 10% to 30% of the initial (maximum) contract price, but it cannot exceed the amount of the contract performance security. In some cases, 100% prepayment is possible, but it is applied only in a number of industries and is regulated not only by Federal Law-44, but also by other regulatory documents.

Important

Order of the Government of the Russian Federation No. 737-r (dated April 21, 2016) introduces a list of goods and services for which advance payments are not provided. In total, the list includes 32 items.

What are the payment options for the contract? In fact or prepayment? Is the prepayment rate fixed? (For example, prepayment is only 40%)?

Benefits of the option

The Mobile Payment function allows Beeline subscribers to save free time by purchasing goods and paying for services remotely. There is no need to download any additional applications to your phone.

The main advantage is that the service is free of charge.

Main advantages of the option:

- service maintenance is free;

- an additional account for making payments is provided without a monthly subscription fee;

- replenish a separate balance in any convenient way;

- the ability to use funds for various consumer needs and commerce;

- making transfers and purchases without leaving home;

- independent account control online 24/7.

The only drawback of the product is that some services through which money is transferred charge an additional commission.

Answer

Payment options under the agreement may vary depending on the situation. This can be an advance payment, post-payment or subscription fee. So, “the procedure for settlements between the parties” is one of the important sections of any agreement and, depending on the type of agreement that is concluded, the parties themselves must determine the procedure for settlements.

Read how to correct errors in accounting documents for paid services in.

The following payment options may be established in the contract for the provision of paid services:*

- advance payment or advance payment (services are paid until they are received by the customer);

- payment for services after they are provided (services are paid after they are provided in full);

- subscription fee (services are paid regularly in the same amount for the consumption of an unlimited volume of services).

All payment options have their own advantages and risks for the customer.

Attention! For some types of services, it is necessary to indicate the procedure for their payment.

These are educational services and most communication services (clause 14 of the Rules for the provision of paid educational services, approved by Decree of the Government of the Russian Federation of July 5, 2001 No. 505, clause 54 of the Rules for the provision of local, intrazonal, long-distance and international telephone communication services, approved by Government Decree RF dated May 18, 2005 No. 310, clause 20 of the Rules for the provision of mobile communication services, approved by Decree of the Government of the Russian Federation dated May 25, 2005 No. 328, etc.).

When the customer needs to pay for services if the payment procedure is not agreed upon in the contract

In this case, payment is made within a reasonable time after the provision of services in full or within seven days from the date of presentation of the demand by the contractor (Clause 2 of Article 314 of the Civil Code of the Russian Federation). Otherwise, the customer will have to pay interest under Article 395 of the Civil Code of the Russian Federation or a contractual penalty for late payment for services under Article 330 of the Civil Code of the Russian Federation. However, the executor may be refused to collect the contractual penalty if the court cannot establish the period of delay (resolution of the Seventh Arbitration Court of Appeal dated October 28, 2009 No. 07AP-7137/09 in case No. A67-2985/09).

Very often, the contract makes payment and the period for payment of remuneration to the contractor dependent on:

- from an action or decision of a government body;

- from the actions of third parties;

- from achieving a different result.

However, in practice, the courts refuse to collect such payment, since setting the condition for the payment of remuneration depending on the above events contradicts Articles 779 and 781 of the Civil Code of the Russian Federation (resolution of the Constitutional Court of the Russian Federation of January 23, 2007 No. 1-P, FAS West Siberian District dated January 21, 2010 in case No. A03-3041/2009, FAS Moscow District dated June 15, 2010 No. KG-A40/4882-10 in case No. A40-136500/09-21-954).

Prepayment*

Benefits for the customer:

- The agreement may provide for a provision on interest for using a commercial loan in the form of an advance payment (advance payment).

Risks for the customer:

- if the counterparty does not fulfill the obligation to provide services, then difficulties may arise with the return of the advance payment;

- if the customer himself violates the obligation to prepay, he will have to pay the contractor an advance payment and a contractual penalty (clause 1 of Article 330 of the Civil Code of the Russian Federation) or interest under clause 1 of Article 395 of the Civil Code of the Russian Federation.

A big disadvantage of prepayment for the customer is also the fact that funds are withdrawn from circulation before receiving the service.

In addition, even if the customer fails to pay the advance payment, the contractor may provide services and demand payment for them.

If the parties have chosen the prepayment option, then the contract must indicate the following.

1. Term and amount of prepayment:

- the period can be determined by a calendar date or a period of time that occurs before the completion of the process of providing services or its stage (Articles 190–194 of the Civil Code of the Russian Federation);

An example of the wording of the terms of an agreement on the prepayment period*

“The Customer undertakes to pay _________ 20__ (the calendar date is indicated)” or “The Customer undertakes to pay for the services no later than ______ (number of days) days from the date of _________ (the event that must inevitably occur is indicated).”

- the amount of prepayment can be specified in a certain amount of money or as a percentage of the total price of services;

An example of the wording of the terms of the agreement on the amount of advance payment*

“The customer undertakes to pay for the services within the following terms:

until “___”_________ 20__ – 50% of the price of services;

by “___”_________ 20__ – the remaining 50%.”

“Payment for services is carried out by the customer in accordance with the payment schedule in accordance with Appendix No. 1, which is an integral part of this agreement.”

- in case of dividing the payment into parts, you must indicate the period and amount of the remaining part.

An example of the wording of the terms of an agreement on partial prepayment

“The customer undertakes to pay an advance payment in the amount of ___________ by “___” _________ 20__.

The customer undertakes to pay the remaining portion in the amount of ______________ within _________ days from the date of signing the service acceptance certificate.”

2. Interest on the prepayment amount – commercial loan (clause 1 of Article 823 of the Civil Code of the Russian Federation).

If such a condition is included in the contract, the contractor will be obliged to pay interest on the amount of the advance payment (advance payment). In this case, it is recommended that the contract specifically emphasize that “the contractor is provided with a commercial loan in the form of an advance payment (advance).”

It is necessary to indicate:

- interest rate;

- point at which interest begins to accrue.

An example of the wording of the terms of an agreement on prepayment on the terms of a commercial loan

“Interest is accrued on the advance amount at the rate of ___% per annum for each day from the moment the contractor receives the advance payment amount until the customer receives the services.” If the interest clause is not provided for in the contract, then it will be considered that the prepayment is not a commercial loan. This means that the customer will be able to recover only interest under Article 395 of the Civil Code of the Russian Federation for the period of delay in the provision of services.

Attention! The customer will be able to return the advance payment from the contractor who did not provide services only after termination of the contract, unless otherwise provided by law or agreement of the parties

This is due to the fact that, as a general rule, the parties do not have the right to demand the return of what was performed under the obligation before the change or termination of the contract (clause 4 of Article 453 of the Civil Code of the Russian Federation).

Moreover, the Supreme Arbitration Court of the Russian Federation indicated that the provisions on unjust enrichment are subject to application only to the requirements:

- about the return of erroneously executed, as well as

- on the return of what has been performed in the event of termination of the contract.

(clause 4 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 11, 2000 No. 49 “Review of the practice of considering disputes related to the application of rules on unjust enrichment” (hereinafter referred to as information letter No. 49), clause 65 of the resolution dated April 29, 2010 Plenum of the Supreme Court of the Russian Federation No. 10, Plenum of the Supreme Arbitration Court of the Russian Federation No. 22 “On some issues arising in judicial practice when resolving disputes related to the protection of property rights and other property rights” (hereinafter referred to as Resolution No. 10/22)).

Thus, as a general rule, the customer can require the contractor to return the transferred advance payment only after:

- the contract expires, or

- the parties sign an agreement to terminate the contract, or

- refuses to fulfill the contract unilaterally.

Payment upon delivery*

Benefits for the customer.

In case of poor-quality provision of services or violation of the deadline for their provision, the customer may refuse to pay for the services (clause 1 of Article 711, clause 1 of Article 720, clause 783, clause 2 of Article 405 of the Civil Code of the Russian Federation). This condition encourages the contractor to provide proper and timely services.

Risks for the customer.

The customer may be required to pay interest on the price of services from the moment of their receipt (acceptance) until the moment of payment under the contract.

If the parties have chosen the option of payment upon delivery, then the contract must indicate the following.

1. Payment term

The period can be determined by a calendar date or a period of time that occurs after the completion of the process of providing services or its stage (Articles 190–194 of the Civil Code of the Russian Federation). You can also associate the payment deadline with an event that inevitably must occur or has occurred (for example, acceptance of services, conclusion of a contract).

An example of the wording of the terms of an agreement on the payment period

“The customer undertakes to pay on _________ 20__ (calendar date is indicated)”

“The customer is obliged to pay for services no later than ______ (number of days) days from the date of signing the service acceptance certificate.”

2. Interest for using a commercial loan in case of deferment or installment payment

This condition is the opposite of the condition on interest for using a commercial loan in the form of advance payment (advance payment). If it is included in the contract, the customer will be forced to pay interest on the price of services from the moment they are received (accepted) until the payment is made under the contract.

It is beneficial for the customer to avoid including this condition in the contract.

Cost control

Many techniques have been developed to control current communication costs:

- Sending a request *110*45#call;

- Possibility to connect. After connecting it, you will be able to receive a message with all the necessary information (amount to be paid, payments made, balance of funds before blocking). To do this, just dial the command *110*321# or call 067409321;

- Activation of the “Personal spending threshold” option is performed using the USSD request *110*41*amount#call. With its help you can set your limit. As soon as you exceed it, the operator will notify you via SMS. This service is free. Information about the established limit can be found by dialing *110*43#.

Subscription fee*

Benefits for the customer:

- the volume of services ordered and consumed depends on future events and actions of the customer;

- the customer can refuse to consume services, and then he will not have to pay a fee.

An example of the wording of the terms of a subscription fee agreement

“The customer undertakes to pay a fee in the amount of ___________ rubles no later than ___ of each day following the date of payment. throughout the entire duration of the contract."

Risks for the customer.

If the customer consumes minimal services, he will still be forced to pay a fixed fee on time.

Advice

When choosing a payment procedure, you must also take into account the content (nature) of the services provided, since the consequences of improper execution or non-fulfillment of the contract (for example, in the case of late payment for services) may depend on this.*

Postpayment is a very common concept among entrepreneurs. This is a powerful tool that allows you to find the right and reliable supplier and gain time to raise funds to pay for the goods. This article will explain the essence of postpayment and show how you can use it.

Beeline tariffs where postpayment is available

Beeline offers the possibility of postpayment at the following tariffs.

| Rate | "All for 300" | "All for 500" | "Everything for 1000" | "All for 3000" |

| Ability to send messages | 300 SMS | 300 SMS | 1000 SMS | 3000 SMS |

| Limit of permissible debt, rub. | 300 | 500 | 1000 | 3000 |

| Number of minutes | 600 | 1100 | 2200 | 3300 |

| Amount of advance payment, rub. | 300 | 500 | 1000 | 3000 |

All Beeline postpaid tariffs have similar conditions, only the volume of minutes, GB, SMS and allowable debt differs.

Postpay - example

Let's look at an example. You have decided to start a new business and import wholesale goods from China and sell them at retail in your country. You contact the supplier and agree on a time frame for receiving the goods. Since the quality of the product and the reliability of the seller are not yet entirely known to you, you set the condition for postpayment (payment upon delivery). You receive the goods, and only then pay money to the supplier. This is beneficial for both parties to the transaction. For you - because you do not risk losing your money and can return the goods back to the supplier if something does not suit you. For the supplier - because in this way he is given the opportunity to prove the quality of his product.

Thus, postpayment is a very profitable tool for doing business, which should not be underestimated, especially if it is a large and long-term project.

What is prepayment and postpayment? Subscribers usually encounter similar concepts when choosing a new tariff. Specialists from cellular company offices unanimously say that using tariff packages with a postpaid payment system is much more profitable and economical. The essence of this proposal is that the consumer first uses all the possibilities of his tariff, and only then pays all the bills presented for the services used. With all this, users know that they should not rely on the word of a consultant.

Quite often, cellular companies present their own developments in a light favorable to them, shyly keeping silent about their shortcomings and further pitfalls. As a result, the subscriber receives completely opposite conditions for communication services than were stated when drawing up the contract.

So, let’s figure it out – prepaid payment system or postpaid, what to choose?

All tariff plans from cellular companies are conditionally divided into two categories, which directly depends on the mutual payment regime between the cellular operator and the consumer.

In practice it looks like this:

- Prepaid payment system.

- Postpaid payment system.

Everything here is extremely clear and simple. The consumer replenishes his own balance with a set amount of funds and only then can use all communication services, until a month or a day has passed, if the subscription is daily. It is tariffs with a similar payment system that are used by 85% of all mobile communications consumers.

In this situation, the user first uses all the packages of communication services provided, and only after that pays the invoice issued for this by the cellular operator. This is the main difference between prepaid and postpaid.

Difference between postpaid and prepaid payment system

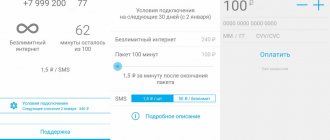

When using prepayment, you first pay a certain amount, which depends on the tariff. Then expenses are subtracted from it. They consist of regular subscription fees and additional expenses. Once the balance is exhausted, the provision of services by the mobile operator stops. To continue, you need to deposit funds.

With postpayment, the operating principle differs from that described here. In order to switch to it, you need to select one of the tariffs on which it is used. To do this, you will need to sign an agreement with the company. The document will indicate the maximum amount of debt.

When using the Internet, talking, sending SMS messages, the client acts freely, even in the absence of funds. The mobile operator keeps records and determines the amount of debt at the current moment. Payment occurs when the provider sends the client an invoice. 20 days are given for payment. The arrival time of the receipt varies and depends on the subscriber’s responsibility. When debts are paid off on time, bills will arrive less frequently. For good payers, Beeline may increase the debt limit.

We recommend: 5 advantages of the “All for 500” tariff from Beeline

It happens that the provided limit is not enough, then the user can, at his discretion, add an additional amount to the balance. This situation usually occurs when using roaming - the costs during this time increase sharply.

A few words about per-minute billing

You can also note another calculation system - per-minute billing. In essence, this is a type of prepaid payment system, but the difference is that subscribers here do not pay for the packages of bonus minutes provided, but for each minute actually used.

Such an offer will be beneficial for those consumers who rarely communicate on a cell phone.

Currently, every mobile operator has tariff plans with per-minute billing.

Possible problems

There may be situations when the Mobile Payment function becomes unavailable. The operator may disable the service for the following reasons:

- the subscriber has recently connected to the television system, therefore he does not yet have access to full use of the system;

- there is no money on the smartphone’s separate balance to make financial transactions (you need to top up your account and the option will work);

- the service is blocked by the provider for technical reasons.

The company's offer is in great demand among customers. Therefore, the service requires constant updating and the addition of new options, as a result of which the function is periodically blocked by the operator for work.

Why are operators actively promoting postpaid tariff plans?

Postpaid tariff plans will essentially be beneficial only to those consumers who spend a lot of money on communication services. So why then are mobile operators so vigorously promoting postpayment on their tariffs?

According to cellular companies, the answer is obvious. They claim that postpayment has the following advantages:

- Postpaid is not subject to any restrictions in the field of cellular communication services. Subscribers are constantly online and do not worry that at the most inopportune moment the money on their personal balance will run out;

- unlimited access to the Internet. Basically, such offers give users large packages of high-speed traffic, which can be used throughout the country, regardless of the region of residence;

- bonus programs. The mobile operator and its partners systematically organize various promotions and offer postpaid subscribers decent discounts on their services.

Note! Invoices presented for used postpaid services must be paid within the next 20 days after presentation.

This concludes our brief review. Today we looked at the main differences between the prepaid payment system and the postpaid one. Which option is good and which is not is up to the subscriber to decide. There is no consensus here.

DELIVERY AGREEMENT No. __________ (conditional address of the facility: __________________) Moscow "__" __________ 2012. ______________________________, hereinafter referred to as the “Supplier”, represented by ___________, acting on the basis of ________________, on the one hand, and __________________________, hereinafter referred to as the “Buyer”, represented by ___________________, acting on the basis of ____________, on the other hand, have entered into this agreement (hereinafter referred to as the “Agreement”) about the following: 1. SUBJECT OF THE AGREEMENT 1.1. Under the Agreement, the Supplier undertakes to supply the Buyer with goods (_____) corresponding to the names, assortment and prices of the goods specified in the Protocol for agreeing on prices for goods (Appendix No. 1 to the Agreement), and the Buyer undertakes to accept and pay for the goods on the terms of the Agreement. 1.2. Upon conclusion of the Agreement, the Supplier shall provide the Buyer with duly certified copies/originals of the following documents: - certificate of state registration of a legal entity (for legal entities registered before 2002 - certificate of entry into the Unified State Register of Legal Entities registered before 2002) /an individual as an individual entrepreneur (copy); — certificate of registration of a legal entity with the tax authority at the place of location on the territory of the Russian Federation (for legal entities) / certificate of registration of an individual with the tax authority at the place of residence in the territory of the Russian Federation (for individual entrepreneurs) (copy); — An extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, received no earlier than one month before the date of conclusion of the Agreement (original); — Charter (for legal entities) (copy); — A document evidencing exemption from VAT (except for cases where the Supplier is a VAT payer) (copy); — Power of attorney (original). 2. AMOUNT OF TRANSACTIONS UNDER THE AGREEMENT AND PAYMENT PROCEDURE 2.1. The amount of all deliveries of goods under the Agreement must not exceed _________ (___________) rubles __ kopecks, including VAT 18% _______(_________) rubles __ kopecks. 2.2. Payment for goods is made in cashless form in the following order: The Buyer pays for the goods within ___ (______) days from the date of receipt of the goods from the Supplier. 2.3. The day of fulfillment of financial obligations under the Agreement is the day of debiting funds from the settlement account of the Payer (Party to the Agreement). 3. BUYER’S APPLICATION, DELIVERY TERMS 3.1. Delivery of goods under the Agreement is carried out on the basis of the Buyer’s applications, the Buyer’s application form is approved by the Parties in Appendix No. 2 to the Agreement. 3.2. The supply of goods for each Buyer’s application is a separate transaction carried out under the Agreement. 3.3. The Buyer's application shall indicate: name (article if necessary), quantity, assortment, price per unit of goods (with explanation: price without VAT or price with VAT) and total cost of goods (without VAT and with VAT). 3.4. The conclusion of each individual transaction for the supply of goods under the Agreement is carried out as follows: 3.4.1. During the term of the Agreement, the Buyer sends to the Supplier's email address __________ a scanned copy of the Buyer's application, signed by its authorized representative. 3.4.2. Within 2 (two) days from the date of receipt of the Buyer’s application, the Supplier is obliged to send to the Buyer’s email address ________ a scanned copy of the invoice signed by an authorized representative of the Supplier and a scanned copy of the Buyer’s application approved by the Supplier (approval of the Buyer’s application is carried out by affixing the signature of an authorized person and stamp of the Supplier on the Buyer's application). 3.4.3. The Supplier's invoice must contain a reference to the date and number of the Buyer's application, an indication of the amount payable under the Buyer's application. 3.4.4. The Parties have agreed: * in case of discrepancies between the Buyer's application and the Supplier's invoice, the Parties are guided by the information contained in the Buyer's application; * if an invoice was not issued for any Buyer’s application approved by the Supplier, then an invoice that does not indicate a reference to a specific application and issued by the Supplier after the application was sent to him is recognized as an invoice issued for this Buyer’s application. 3.5. Delivery of goods under the Agreement is made by shipping the goods to the Buyer at the address: _______________. 3.6. The Supplier undertakes to transfer the goods to the Buyer within ______ (_________) days from the date the Supplier approves the Buyer’s application. 3.7. Ownership of the goods and the risk of accidental loss and damage to the goods passes to the Buyer on the day the Buyer receives the goods; the day the Buyer receives the goods is the day the Buyer signs the delivery note or acceptance certificate. 3.8. The Supplier, no later than the day the Buyer receives the goods, is obliged to provide the Buyer with documents confirming the quality and safety of the goods, including a certificate of conformity, documents confirming the goods’ compliance with sanitary and radiation standards and other standards, compliance with which ensures the safe operation of the goods. 3.9. If necessary (properties and type of goods), the Goods must be packed in containers that ensure their safety during storage and transportation. The cost of containers and packaging, delivery of goods to the Buyer’s address is included in the price of the goods. 4. ACCEPTANCE OF GOODS 4.1. The buyer must accept the goods and check them for quantity, assortment upon receipt of the goods, and for quality (obvious deficiencies) - no later than 5 (five) working days from the date of receipt. 4.2. If obvious quality defects are detected, the Buyer notifies the Supplier in writing (including by telegram or letter with acknowledgment of delivery or by courier). Notification must be sent within 5 (five) business days from the date of receipt of the goods. The Supplier's representative must arrive at the location of the goods to draw up a report on the defects of the goods within 2 (two) days from the date of receipt of the Buyer's notification. If the Supplier's representative does not arrive at the location of the goods within the specified period, the Buyer has the right to draw up a report on the defects of the goods unilaterally. In this case, the Supplier has no right to challenge the said act. 4.3. If obvious quality defects are detected, the Buyer has the right to demand immediate replacement of the goods. If the Supplier does not have the opportunity to replace the goods, the Buyer has the right to refuse the corresponding part of the goods, the entire batch of goods and demand compensation for losses. If the Supplier does not have the opportunity to replace the goods, the Buyer has the right to purchase the corresponding part of the goods from third parties, with subsequent recovery from the Supplier for the losses incurred. In this case, the Supplier is obliged to compensate the Buyer’s expenses for the purchase (including transportation) of the corresponding part of the goods from third parties within 1 (one) banking day from the date of receipt of the Buyer’s invoice. 4.4. The warranty period for the goods is established by the manufacturer; if the warranty period is not established by the manufacturer or is less than 12 (twelve) months, the Supplier provides a guarantee of the quality of the goods for a period of 12 (twelve) months from the date of receipt of the goods by the Buyer. 4.5. If quality defects discovered by the Buyer during the warranty period are identified, the Buyer within 5 (five) days from the date of discovery of the defects notifies the Supplier of this fact. 4.6. The Supplier is obliged to remove the defective goods within 2 (two) days from the date of receipt of the notification from the Buyer. If the Supplier does not remove the low-quality goods within 2 (two) days from the date of receipt of the corresponding request from the Buyer, the Supplier is obliged to reimburse the Buyer for the costs of storage/disposal/replacement of the goods, as well as losses caused by the delivery of low-quality goods. The replacement of goods by the Supplier is carried out within the time period agreed upon by the parties, but not more than 5 (five) days from the date the Supplier receives the Buyer’s notification. 4.7. The burden and costs associated with disposal and/or replacement of defective goods rest entirely with the Supplier. If the disposal and/or replacement of low-quality goods is carried out by the Buyer, the Supplier undertakes to compensate the Buyer’s expenses associated with such disposal and/or replacement within 1 (one) banking day from the date of receipt of the Buyer’s invoice. 4.8. If a delivery of goods is detected in a quantity less than that specified in the Buyer’s application, the Buyer has the right to demand that the Supplier supply the missing quantity of goods. In this case, the Supplier is obliged to deliver undelivered goods within the period agreed upon by the parties, but not more than 3 (three) days from the date of receipt of the Buyer’s request. 4.9. If a supply of goods is detected in a quantity exceeding the quantity specified in the Buyer's application, the Buyer, at his own discretion: - Accepts and pays for the goods at the price specified for this product in the Buyer's application, no later than 10 (ten) working days from the date of receipt of the goods; — Refuses to accept goods delivered in excess of the quantity specified in the Buyer’s application. 4.10. If the Supplier has transferred to the Buyer, along with a product whose assortment corresponds to the Buyer’s application, a product in violation of the assortment condition, the Buyer has the right, at his own discretion: - Accept the product that complies with the assortment condition and refuse the rest of the goods; — Demand that a product that does not comply with the assortment condition be replaced with a product in the assortment provided for in the Agreement; — Accept all transferred goods. 4.11. If the Buyer has not refused goods, the range of which does not correspond to the Buyer’s application, the Buyer is obliged to pay for them at the price specified in the Protocol for agreeing on prices for the goods (Appendix No. 1 to the Agreement). 4.12. In case of transfer of incomplete goods, the Buyer has the right, at his choice, to demand from the Supplier: - A proportionate reduction in the purchase price; — Replenishment of incomplete goods, or replacement of complete goods within 1 (one) day from the date of receipt of the Buyer’s request. 4.13. If the Supplier has not complied with the Buyer’s requirements to complete the goods within the established period, the Buyer has the right to refuse to fulfill the Agreement and demand a refund of the money paid. 4.14. The Buyer has the right, before receiving the goods, at any time to refuse the goods supplied at the Buyer’s request in whole or in part. 5. RESPONSIBILITY OF THE PARTIES 5.1. If the payment deadline for the goods is violated, the Supplier has the right to demand from the Buyer, and the Buyer undertakes to pay an exceptional penalty in the amount of 0.1% (zero point one percent) of the amount of the unfulfilled financial obligation for each day of delay, but not more than 5% (five percent) of the amount of the unfulfilled financial obligation. 5.2. If the deadline for payment for goods is violated, the Supplier has no right to retain any property of the Buyer to secure claims against the Buyer under the Agreement. The goods are not pledged to the Supplier until the Buyer pays for the goods. 5.3. If the Supplier violates the delivery deadline for the goods, the Buyer has the right to demand, and the Supplier undertakes to pay, a penalty in the amount of 0.1% (zero one tenth of a percent) of the cost of the goods at the corresponding request of the Buyer, the delivery of which is overdue. Penalties are accrued for each day of delay in the obligation to supply goods. 5.4. Penalties and fines under the Agreement must be paid within 3 (three) days from the date of receipt of the corresponding request from the Party to the Agreement. 6. DISPUTE RESOLUTION 6.1. If disputes and disagreements are not resolved by the parties through negotiations, such disputes are resolved in the Moscow Arbitration Court. 7. DURATION OF THE AGREEMENT 7.1. The agreement comes into force from the moment of signing and is valid until the end of the calendar year in which it was concluded, and in terms of mutual settlements - until their full expiration. If the deadline for fulfilling obligations under the Buyer’s application, signed during the validity period of the Agreement, exceeds the validity period of the Agreement itself, the Buyer’s application must be executed at the prices specified in the Protocol for agreeing on prices for goods on the day of its submission and in accordance with its terms and conditions of the Agreement. 7.2. From the moment the Agreement is concluded, all relationships for the supply of goods between the parties are governed solely by the terms of the Agreement. The Supplier has no right to issue invoices or otherwise send an offer to the Buyer, except in the manner provided for in the Agreement. 7.3. Either party has the right to terminate the Agreement by notifying the other party in writing 30 (thirty) calendar days in advance, and termination of the Agreement does not relieve the parties from fulfilling their obligations assumed earlier. 7.4. If 10 (ten) days before the expiration of the Agreement, neither party declares a refusal to extend its term, then the Agreement is extended on the same terms for each subsequent calendar year. 7.5. All messages, certificates, applications, agreements, protocols and other documents drawn up under the Agreement and transmitted via electronic communication have legal force until the day the original is presented. A document sent via electronic communication must be presented as a scanned copy of the original document. The Party that sent the documents via electronic communication is obliged to provide the recipient (the other Party) with their originals by hand (by courier), by mail or in another manner agreed upon by the Parties no later than 10 (ten) days from the date of sending a scanned copy of the document. 7.6. The Agreement is drawn up in two authentic copies, one copy for each of the Parties. 7.7. At the time of signing, the following are attached to the Agreement and are an integral part of it: 7.7.1. Appendix No. 1 - Protocol for agreeing prices for goods; 7.7.2. Appendix No. 2 - Buyer's Application Form. 8. ADDRESSES, BANK DETAILS AND SIGNATURES OF THE PARTIES Supplier:Buyer:Name: Name: Legal address: Legal address: Postal address: Postal address: email address:email address:TIN: KPP: INN: KPP: r/s No. 40 ___ ___ ___ ___ ___ ___ in account number 40 ___ ___ ___ ___ ___ ___ in account number 30 ___ ___ ___ ___ ___ ___ account number 30 ___ ___ ___ ___ ___ ___BIC: BIC: From Supplier: From Buyer: General DirectorGeneral Director Appendix No. 1 to the supply contract No. _________ dated "___"______ 201_PROTOCOL OF AGREEMENT OF PRICES FOR PRODUCTS Moscow "__" __________ 201_ ______________________________, hereinafter referred to as the “Supplier”, represented by ___________, acting on the basis of ________________, on the one hand, and __________________________, hereinafter referred to as the “Buyer”, represented by ___________________, acting on the basis of ____________, on the other hand, have drawn up and signed this protocol for agreeing prices for goods (hereinafter referred to as the “Protocol”) on the following: 1. In order to fix prices for goods supplied under supply agreement No.__ dated “__” _____201_g. (hereinafter referred to as the “Agreement”), the Parties approved the following list of goods and prices for them: No. Name of goods Unit of measurementPrice per unit of goods without VAT (rub.)Price per unit of goods with VAT (rub.) Max. Quantity of one-time delivery of goods Max. total quantity of goods is 123452. Prices for the goods specified in the Protocol are valid for Buyer orders sent to the Supplier in the period from ___________ to ____________. 3. If, after the end of the period specified in clause 2 of this Protocol, the parties do not draw up and sign a new Protocol for agreeing on prices for goods, or an agreement to terminate the Agreement, the goods will be delivered at the prices specified in this Protocol. 4. This Protocol is drawn up in two authentic copies, one for the Supplier, the other for the Buyer. Supplier: Buyer: General Director General Director Appendix No. 2 to supply agreement No. _________ dated "___"______ 201_ FORM APPROVAL: BUYER'S APPLICATION No._-_ under supply agreement No._-_ dated "_-_"____-____ 201_-_ Moscow "_-_" ___-____ 201_-_ No. Product name Quantity Unit of measurementPrice per unit of goods without VAT (rub.)Price per unit of goods with VAT (rub.)1——2——3— —Total with VAT:___-__(_-_) rubles __-_ kopecks. Total without VAT: __-__(_-_) rubles __-_ kopecks. VAT (18%):__-___(_-_ ) rubles _-_ kopecks. FROM THE BUYER: General Director __-__ “______-______” upon approval is not signed or stamped /_-_._-_._____-______/ M.p. Supplier:Buyer:General DirectorGeneral Director 6

Features of using the function

The mobile transfer function does not require electronic wallets or bank cards. To make money transfers or pay for services, there must be a sufficient amount on your separate phone account.

There are rules and limits for transactions. In this case, a commission is charged for each transaction. Its amount is calculated immediately when filling out an application for a funds transfer and is indicated in the payment receipt. There is no service fee from the provider.

Services that can be paid for

By activating the “Mobile payment” option, Beeline cellular users have the opportunity to carry out the following financial transactions from an additional account:

- pay for cellular communications, Internet, television channels;

- buy tickets to cinemas and other entertainment venues remotely;

- repay loan debts from financial institutions;

- pay traffic fines;

- make contributions to tax organizations and charitable foundations;

- pay utilities, transportation costs and other consumer needs.

If necessary, subscribers can transfer money from a mobile device to electronic wallets WebMoney, Yandex.Money, bank cards, through the Unistream system.

Through special terminals installed in parking lots, you can pay for a parking space using a cell phone.

Replenishment nuances

Topping up an additional account is carried out in the same ways as the main balance of the phone. The only caveat is that the first digit code of the mobile number “9” is not used.

Replenishment options:

- from bank cards;

- from electronic wallets;

- in Beeline offices;

- through self-service terminals;

- from third-party accounts within the network.

Beeline users can pay via SMS. A notification with the text “Type of payment” is sent to the short number 7878. After this, the system will offer an application form for filling in the details and automatically complete the transaction.

You can top up your balance using a bank card.

Checking your balance

To find out your balance, you need to dial *222# and press the call button. The program will display the remaining money in the additional account on the smartphone screen.