The main reasons for losing money from a mobile account

It’s unpleasant for every person when finances are written off from their balance sheet. It is not always clear why they charge us? Let's look at the main examples that involve writing off funds from the balance.

- Some tariff plans include the ability to connect additional packages. But they are not always free, so all the main points need to be clarified in advance (additional Internet packages).

- Many people order options that make using the tariff plan comfortable. But not everyone remembers that after connecting and using the service for free, you will have to pay for it (for example, music on calls).

- If you don’t know why they withdraw money from your phone, then there is another common reason. Modern operators offer operations that are not paid, but some of them are limited (100 SMS in a package, the rest at an increased price).

- If a person misses a call, a message is sent from his number indicating that he is in touch again. These messages may also incur a fee.

Accidents

You may not remember how you talked to a stranger for half an hour, sent fifty SMS to your home phone, or watched someone cut water on YouTube for 10 hours, but this does not mean that your smartphone is not capable of this without your participation. All you have to do is not lock the screen, put your smartphone in your pocket and put your hand there - anything can happen there. Always make sure you press end call after ending a call or wait for the other person to do so, and lock the screen before putting your smartphone in your jacket or bag.

How to check settings and find out where money goes from your phone

Be extremely careful, because you need to regularly monitor the state of the balance in order to notice the problem in time.

- Automatic software updates via metered Internet can become the main source of financial leakage. The system independently installs platforms and activates subscriptions, for which you have to pay.

- In some cases, people are asked to send a message to a short number in order to receive a particular service. But not all operators indicate that this SMS is paid. Read the terms and conditions in advance to avoid any unpleasant surprises.

Important

Finally, your system may become infected with a virus. In this situation, funds will be withdrawn from your account automatically, regardless of what services and subscriptions you use.

How to check where all the funds went from the balance on MTS

MTS subscribers can see where the money is going from their phone by using the contact center number (0890). Wait for the operator to connect and ask him to explain where exactly your finances were written off.

Dial the combination of characters *152*1#, press the call button. This will allow you to see how much money you have spent on messages. This means you will have the opportunity to control your expenses at any time.

You can find out about your expenses using your personal account on the operator’s website. At the very beginning, go through a simple registration procedure on the resource. Enter your number so that you can receive a message with your personal account activation code.

Now go to your personal account by finding the “Current expenses and account status” command. A page will appear on the screen listing costs for the selected period. All important data is indicated here. To display the information in a more convenient form, click on the item called “View expense history.”

If you want to see how much money you spent on mobile communications last month, select the item called “Past Months Expenses.” This is very convenient, since all the data will be displayed on the page.

Check to see if you have any paid subscriptions. Dial *152*2# to see all options. It is also possible to send a message with the text 0 to the short number 8111.

Where does the finance from Tele2 go?

You can dial the operator - 8-800-555-06-11 or. Experienced consultants will sort out the issue.

You can go to the Tele2 operator website by typing the appropriate request in any browser. You will be taken to the main page where you need to log into your personal account. If you are not yet registered on the resource. You will see a window where you enter your number. You will receive a password that you must enter. Now select the section called “Costs and Payments”.

You will receive detailed information on expenses, so you will understand where the funds went from the account. This is a very convenient service that allows you to plan your expenses. You can request details by email.

Check if you have paid subscriptions by sending a request to the short number *153#. After that, press the green call key. You also have the opportunity to dial 611 by talking with qualified consultants.

If none of the methods helped you, go to the Tele2 office. Here experts will help you if you took your passport with you.

Who makes the arrest?

Bailiffs begin searching for property and seizing it on the basis of a writ of execution issued by the court. After this, within 3 days from the date of receipt of the document, the employee initiates proceedings and gives the defendant 5 days to voluntarily repay the debt. If the debtor does not use it, the bailiff has the right to send an order to the bank to seize part of the funds on the card. From this time on, proceeds to the account will be withdrawn in favor of the creditor.

A banking organization can also seize an account if it is given this right in the agreement. In such a situation, if there is a delay, the money will be written off without a court decision. Therefore, it is recommended to carefully study the terms of the agreement before signing.

Why money is withdrawn from Beeline

If you want to check why finances are being withdrawn from your balance, dial 0611. An experienced operator will answer you and help you understand the issue.

Log into your personal account on the website to get the necessary information. To do this, enter your username and password, find the item with the appropriate name and see how much money you spent on calls and messages. Thanks to such opportunities, saving money will be much easier.

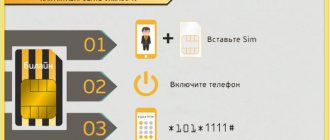

You can find out which paid subscriptions are connected to your number by dialing the symbol combination *110*9#.

Or go to the “My services” item in the service menu to find out what options are connected to your number. Another way is to visit your personal account on the operator’s website.

Where do they withdraw money from Megafon?

You can dial 8-800-550-05-00 to chat with professionals. They will tell you where the rubles are going from your balance.

Log in to the site by visiting your personal account. It contains the item you need, which you need to select. Here click on the “Order details” section. A detailed description of expenses for the period of interest will be sent to your number.

You can check which paid subscriptions are connected by dialing *105*11#. After that, click on the green call button. You can send a message with the text INFO to the short number 5051 or call 0500 to ask an experienced operator any questions you have.

Call to MTS operator

To find out why MTS withdraws money, simply contact specialists using the short number 0890. After this, you will hear a voice menu, the informant will offer you a number of specific actions. You can select them or wait for the operator’s response and ask him where the funds from your phone went. It will provide you with all the necessary information about the status of your balance, as well as all the latest payment transactions. The call to the MTS operator is free.

Description of fraudulent schemes

So, scammers withdraw money via phone in different ways. Let's look at the most common schemes:

- Quiz - the user is invited to win a valuable item by sending as many messages as possible to a certain number. This is a kind of message that can withdraw money from a mobile phone in the amount of several hundred hryvnia. You can win $100 by spending $1000 on messages.

- Increasing the balance - a notification is sent to the subscriber’s number that he needs to top up his account with a certain amount in order for the balance to increase several times. But this should only be done using a special method. If you believe the scammers, you will enrich them by several hundred rubles.

- SOS – a message asking for help is sent to the subscriber’s loved ones. It contains a text according to which a person is required to send a certain amount of money to a friend who is supposedly in trouble, which he will definitely return.

- Error in money transfer - an SMS is sent to the subscriber’s phone indicating that a certain amount of money has been added to his balance. A few seconds later, a person calls him asking for a refund because the payment was sent incorrectly. Do not rush to send amounts without viewing your actual balance.

Now you can see where the money is going from your phone using the methods described above. Don't fall for the tricks of scammers so as not to lose your finances in vain.

Features of withdrawing money from a Sberbank card for debts

Withdrawing money from a Sberbank card can occur in the following cases:

- Debt on bank loans (without collateral and property collateral).

- Failure to pay a fine (for example, for drinking alcohol in a public place).

- Debts to utility services for housing and communal services.

- Accumulation of arrears in alimony payments.

- Customs duties (for example, for registering an imported car).

But don’t panic if the fine is 100 or 500 rubles. In this case, withdrawing money from the card is unlikely.

When bailiffs seize part of the debtor's wages, it should be remembered that the maximum amount is 50% of the monthly amount. Bailiffs do not have the right to withhold more than half of the salary.

Attention! Need protection from bailiffs? in the form, go to the legal assistance , go, free !

In addition to bailiffs, the following may be involved in withdrawing money from a credit card:

- tax and customs authorities;

- courts of general jurisdiction;

- executive body of the FSFM.

The procedure for withdrawing money for fines or alimony does not require any special measures, since the bank has everything necessary to carry out collection. Of course, we are talking about access to the debtor’s personal data.

Viruses on the Internet and dangerous sites

Internet users are also not immune to fraud and deception. Often the site takes money from the phone, but the person cannot understand anything. In some cases, the web service asks for a number for downloading certain information. Remember that you cannot provide data on dubious and unverified resources, as scammers will easily withdraw funds from your mobile account.

This is interesting

Another common deception scheme is sending links with false avito. Fraudsters take advantage of the popularity and reliability of the resource, deceiving its fans. That is why make sure that the site is authentic before making basic transactions.