There are a huge number of ways to get divorced now. When many people learn about one scheme, scammers come up with something new. Easy payment MTS fraud is a fairly discussed topic. Now on many resources people claim that they have encountered a similar problem. But it’s worth understanding all the nuances in more detail.

The essence of fraud

Thanks to “simplified” authorization in the service management account, fraudsters have the opportunity to fraudulently obtain money from subscribers’ accounts. To do this, scammers install an MTS application on their phone and begin calling subscribers, trying under various pretexts to obtain the password received in an SMS message. After authorization, the attackers begin to transfer money from the subscriber’s account. Since fraudsters do not have access to the balance and it is impossible to view it, the transfer amounts are determined by the “selection method”.

In addition, attackers can issue a promised payment for a fairly large amount of money to the “victim” number.

Victims at the hands of scammers say that they received a message from MTSPAY on their mobile phone, which contained a code. And literally in a matter of moments, an unfamiliar number called, and the person from the other end of the line, under various pretexts, tried to get the code from the message.

MTS is aware of the fraud, but the operator’s reaction does not inspire confidence.

Most often, scammers introduce themselves as employees of a cellular company and report that a paid service was accidentally connected to the number; in order to disable it, you must provide the code from the received message .

Also a fairly common legend is the inattentiveness of the caller. A person asks for a code because he replenished his account incorrectly, and he needs the code to get a refund. Attackers can also “play” on the gullibility of subscribers, for example, by informing that a person’s friends or acquaintances have purchased an expensive gift, and in order to receive it, they must provide a code from an SMS message.

What is “Easy Payment” MTS and scammers: how the scheme works

requires entering a password for authorization. The numerical value is generated automatically and sent to the user's mobile phone number. The protection system is standard. A similar identification option is used even by large financial organizations. The high level of protection is due to the absence of the possibility of hacking the automatically generated code.

What is divorce? We all know very well that codes sent to a personal number or email cannot be communicated to strangers. Any application and system always notifies about this, but MTS did not even bother to notify all clients about the connection, which misled most people. How did attackers manage to deceive mobile subscribers?

There are several options for the theft scheme, but they all have a similar structure:

- A person calls the subscriber and introduces himself as an MTS employee. An attacker can tell any legend: an erroneous connection to a service, blocking an account, or winning a current promotion. Whatever he says, it will definitely interest the MTS client.

- Then he will offer you a simple solution to the existing issue - by sending an SMS confirmation, and you will tell him the code to confirm the operation.

- As a result, you receive a notification that a certain amount has been debited from your balance.

In reality, there is simply no situation. The attacker leaves a request using , and you yourself and voluntarily tell him the code. The code allows the fraudster to gain access to your personal account, after which he has the opportunity to manage the mobile account as he sees fit.

A huge disadvantage of the service provided by MTS is the absence of the need to confirm financial transactions when using the Easy Transfer service. If this measure had been provided, then attackers would not have been able to obtain funds in this way.

How to understand that you have been deceived?

We recommend not to share this code with third parties, even if you think that they are MTS employees.

If, after receiving the message and the attacker calls, the code from the SMS is called, then money will begin to be debited from the mobile phone account. In this case, the write-off amounts will be chaotic, and the transfer statement will show successful and unsuccessful attempts to transfer funds.

A typical statement if you have become a victim of a scammer.

Pay MTS RU – service management

In this category of the Pay MTS RU website, a mobile and Internet connection subscriber can regulate all connected services and activate new ones. This applies to mobile communications, the Internet, SMS, and popular options. For example, configure the parameters of the unified Internet, return 20% for payment for Internet services. If an MTS user wants to add one of the numbers to the blacklist, he can refer to this section. Voice mail can also be set up here.

Those who frequently visit social networks are recommended to go to the “MTS Online” subcategory to take advantage of the chance to correspond on social networks without limits. Moreover, all SMS messages are free, without a limited number, for only 3 rubles per day. Additional parameters of SMS messages are valid with the activation of the SMS Pro service. It comes to the aid of busy MTS network users who have no time to respond to SMS. By setting up the function of sending SMS and answering machine, all interlocutors will be informed that the subscriber is busy.

And, of course, in the “Service Management” section on the Pay MTS RU website you can connect the popular ones, My Content, MTS Search. “Gudok” is a service for setting a non-standard melody for incoming and outgoing calls instead of banal beeps. The “My Content” service allows you to subscribe to constant newsletters of information on any topic: music, videos, games, horoscopes, sports and entertainment. MTS Search helps to determine the location of family and friends using an interactive map, and search for the addresses of the necessary establishments via a mobile phone.

MTS Gudok connection services, video:

How can I get my money back?

In order to return stolen money, you must complete the following operations:

- Call the CALL center of the company to whose number the transfers were made and explain the situation. After contacting, a request for a refund will be submitted.

- To complete the application, you need to go to the service office with your passport.

Thanks to the above operations, it will be possible to return almost all the money “stolen” from your mobile phone account. Transfer fees are non-refundable (the minimum amount is 10 rubles, and 10.4 percent is also charged for each transfer made) . In MTS, the commission is not refundable, since it was charged for the provision of translation services.

We make payments from a bank card

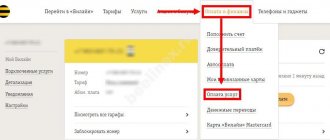

- Login to the application.

- Go to the payment section via bank card.

- Choose what you want to pay for. If there is no suitable one in the list, you can independently enter the bank details by which payment will be made.

- In the form that opens, enter the card details – card number, owner’s name, card expiration date, CVV2/CVC2.

- Enter the payment amount.

- Check that all information has been entered correctly.

- Click the submit button.

After this, the payment will be sent within a few minutes. Do not forget to take into account that the service charges a commission of 10 rubles for carrying out the operation. In addition, the bank that owns the card may charge its own additional commission.

How to protect yourself from further fraud?

To prevent scammers from continuing to transfer money from a cell phone number, you should change the password to the “Easy Payment” service. This operation can be performed using the following request: *117#. Then you need to enable the option “prohibition of the return of part of the advance.” To activate the service, you need to call the contact center of the mobile operator at the following numbers: 8 800 250 0890 or 0890.

First of all, recover your application password.

It is worth remembering that under no circumstances should you share the code from received messages. If any service is connected by mistake, you can disable it yourself through your personal account. Do not trust strangers or provide any personal information. Vigilance will allow you to protect yourself and your loved ones from all kinds of scammers.

Bank cards

Also, plastic bank cards from MTS Bank became available to clients of Mobile Telesystems PJSC. You can order and use a payment instrument both via the Internet and when visiting an MTS cellular communication store.

MTS Smart Money

The VISA Platinum bank card, which can be issued to MTS Bank clients, allows the owner to:

- Use mobile communication services for free on Smart, Hype TPs, as well as options for tablets;

- Subscribers of Mobile Telesystems PJSC do not pay for servicing plastic tools;

- SMS information is provided to the user free of charge;

- Possibility of contactless payments with NFC technologies;

- Preferential conditions for a credit limit on a card account, free period of use up to 51 days, loan amount up to RUB 299,999.00;

- You can manage your finances using online banking, a mobile application or the SMS-Bank-Info service.

To issue a plastic card, the client just needs to contact any MTS mobile phone store with a passport of a citizen of the Russian Federation and within 15 minutes he will be provided with a payment instrument.

Important! To use mobile communications at preferential rates, the subscriber must maintain a certain level of monthly plastic spending and a minimum account balance. Amounts depend on the tariff plan the client is on

Debit card MTS Money Weekend

A debit card from MTS allows customers to use a large number of privileges without overpaying for services. Product Main Features:

- Cashback for purchases made during the past week is credited every Friday to the client’s account in the amount of 5% of the total amount;

- 6% on the balance of the client’s own funds;

- Free use of plastic, subject to purchases in the amount of 15,000 rubles. monthly, or the average daily minimum balance on the plastic account from RUB 30,000;

- The cost of producing the instrument is 299 rubles;

- Possibility of making contactless payments using a smartphone, auto payment services, etc.

Attention! You can withdraw money from your card account for free at ATMs of all Russian banks

Credit card MTS Money Weekend

MTS Bank offers clients to issue credit cards with favorable conditions for using the limit and additional privileges. Basic product terms for customers:

- The grace period for using borrowed funds is 51 days;

- Free registration and release of plastic;

- Withdrawal of the cardholder's own funds from ATMs of any banks in the Russian Federation - no commission;

- Registration of the product only requires a passport of a Russian citizen;

- Cashback on goods purchased using the card – 5%;

- Participation in the MasterCard privilege program.

With a credit card, the client is given the opportunity to use Internet banking and the MTS Money mobile application for free.

Important! To close a credit account and refuse plastic, the user needs to repay the loan amount, taking into account accrued interest and fees

Is it worth disabling the service?

If the client already knows about this deception scheme, then there is no need to look for how to disable the MTS easy payment service. The main condition for performing the operation is the transfer of the code to the scammers. Just don't tell anyone the code and your money will be safe.

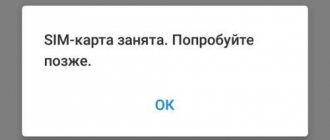

There is a possibility that SMS messages will be intercepted by an infected application and the code will be passed on to scammers. In fact, the chance is extremely low. The official Android store already has virus protection installed.