Autopay allows subscribers not to worry about replenishing their account and paying Beeline bills with a bank card. The user can change the transfer limit and suspend the service. To disable the “Autopayment” option in Beeline, you can unlink your bank card, deactivate the subscription with the help of a call center employee, or turn it off yourself through available services.

Personal Area

Disabling Beeline autopayment from your phone is possible using the application and the “Personal Account” service, which can be found on the operator’s website.

- Open the service using your password and login or phone number;

- Go to the connected services tab;

- Select the one you need and click “Disable”.

This method works in a similar way both on the website and in the operator’s mobile application. You can refuse Beeline autopayment on your phone in another way.

Find out how to withdraw money from a Beeline phone in another article.

Shutdown options

“Autopayment” is a service that allows you to automatically top up your account per day for a total amount of up to 10,000 rubles. Through your personal account, you can manage financing: change the way money is written off, reduce or increase the payment, without attaching a bank card to your number. The desire to disable may arise when changing the tariff plan. If a person begins to spend less money on mobile communications or switches to per-minute billing, then it is unknown how much money will be required to deposit at the end of the month. Then it is more convenient to pay upon the fact, at the end of the reporting period. Methods for disabling AutoPay are given below.

Through your personal account

If the user has the “My Beeline” application installed or has an authorized profile on a virtual resource, then the algorithm of actions is as follows:

- Find the “My Auto Payments” section.

- Select the desired position.

- Press the “Disable” button.

To log in to the portal, just enter your phone number and receive a verification code via SMS.

Short command

It is convenient to cancel the option using *114#. After entering the combination, instructions for use will appear on the screen. You can go through all the steps by selecting the desired sections or switch to the voice menu.

At the operator's office

You can disable “Autopayment” of Sberbank or another organization on your phone at any cellular branch, even if the person is in another city, outside of your home region. The employee is presented with an identification document. After checking personal data, remote deactivation is carried out in the provider’s database. Even if Autopayment was connected through online banking, it will turn off.

We recommend: Ways to listen to voice messages

Call technical support

Unable to access the network or come to a Beeline branch, the shutdown is carried out through the technical support service. You should dial 0611 or 8-800-700-8000. The operator will answer at any time of the day. Before disabling the desired service, the employee will ask several personal questions; this is done as part of security.

Using the voice guide

In Beeline, disabling is available through a voice request using the command 0533. The autoinformer will pronounce menu items, and the user must select the item that matches his request.

Voice menu

To cancel the service, you must:

- Open your device's keyboard;

- Enter number 0533;

- Select the appropriate service from the list of voiced ones;

- Follow the robot's instructions.

We told you about options that answer the question of how to disable autopayment on Beeline using your mobile phone. Now let’s figure out how to refuse the option using the bank’s services.

Read about what MK (mobile commerce) from Beeline is in another article.

Description

The Beeline automatic balance replenishment service is available only to individuals who have been Beeline users for at least 60 days, and eliminates the need to constantly monitor the status of a personal account. If the subscriber has set an acceptable threshold for reducing the balance level at 30 rubles. and indicated the replenishment amount of 150 rubles, which means that every time the specified minimum remains in the account, the necessary funds are promptly received from the bank card linked to the number. When the service is triggered, the user receives a corresponding SMS.

- Attention

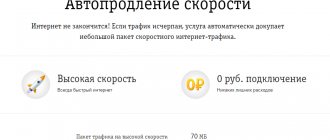

- The Beeline number auto-replenishment service does not have a subscription fee or other commission fees.

Operator's office

A fairly simple way is to visit the office of a mobile operator. Just inform the employee of your desire, and in a few minutes the service will be unlinked from your phone number.

It is worth noting that it is not always possible to disable the service using your personal account; it is better to perform this operation using the bank with which you connected it!

Disconnection via bank

You can turn off automatic replenishment through auxiliary services. If activation was carried out through a banking application, then it is easy to disable “Autopayment” on a Beeline number from Sberbank there. Customer support from a financial institution by phone or visiting an office will help with deactivation. When communicating with the operator, you should have your passport with you. Instructions:

- The employee will check the documents and cancel the automatic write-off.

- An SMS message will be sent to the subscriber’s smartphone.

- The verification code must be given to the operator in order for him to complete the operation.

For any questions, you can call Sberbank at 8-800-555-55-50.

ATM

Disconnection via Sberbank ATM:

- Find the nearest banking equipment.

- Insert the card into the receiver.

- Enter your PIN code.

- Find the “Service Management” position.

- Find the "Automatic payment" field.

After pressing the shutdown key, an informational SMS will be sent to your mobile phone about the actions taken in the system.

Online banking or web account

“Autopayment” from a Sberbank card is deactivated in your personal account or through the web application. The algorithm of actions is identical. After logging in you must:

- Select the “Transfers and Payments” tab.

- Go to the “My auto payments” column.

- Click “Cancel payment”.

Repeated setup will require obtaining a secret code, selecting a limit and the date of depositing funds. It is carried out by analogy.

Paying off your debt to your provider using autopayment is profitable and convenient. There are no commission fees, even if a person often leaves the country. The level of data security protection is high, so there is no need to worry about information leakage. However, in some cases it is still advisable to deactivate it.

other methods

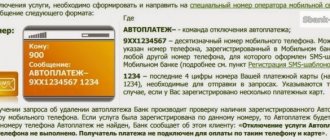

Some may like this method of disabling automatic replenishment of a phone number from a bank card, such as sending a special request. Its text will be “*141*10#, then you need to press the handset to call.

The auto-replenishment function can be provided for several numbers of one user. In this case, you need to enter a specific number.

In this case, the request will look like this - *141* 10*ххххххх# . Then the call button is pressed. xxxxx – should be replaced with a phone number.

also simply call the operator at 0611 , but in order for him to disable the function of automatically transferring money from the card to the phone account, you will need to provide him with personal data and payment details. When registering in the operator's system, the code word required for identification was used. This word will also need to be mentioned in a conversation with the operator.

Before turning off autopayment, you should consider whether it is really necessary. After all, the function is convenient and guarantees that the phone will always be in working order (if only there is always money on the bank card).

Features of "Autopayment" on Beeline

Not all users remember when and how much they need to top up their balance. Some people simply don’t keep track of the amount of money in their account. That's why Beeline provides one. The essence of the service is that the user’s bank card is attached to the phone, and when there is less than a certain amount of money left on the phone, the system automatically tops up your balance from the linked card.

The advantages of the service are obvious:

- Scale. The user can connect 10 numbers to one card at once, so the balance will not run out not only for him, but also for his children, spouse and other necessary people. If there are funds on the card, then there will always be money on the connected numbers and the balance will not go into the minus.

- Availability. The service is provided free of charge and works even in roaming. This is convenient for travel lovers who do not know where abroad they can spend money on their phone. In any convenient place and at any time, wherever a person is, his balance will be in positive territory.

- Convenience. Now your balance will not suddenly become minimal at the most unexpected moment. There just needs to be enough money on the card to top up your balance.

A special feature is its complete safety. No one can track your payments because the information is specially encrypted. And the most important thing is that the moment of error is excluded when the user, having mixed up one digit, paid for a completely different number. You can only pay for the number that is actually connected. It is very difficult to return money sent by mistake. With a linked card, the required number is topped up every time.

Another advantage is the complete absence of commissions. But, at the same time, the company has provided a number of limits that must be observed. You cannot top up your account by more than 10,000 per day, and 15,000 per month. There should be no more than 10 linkings per year. The number of linked cards should not be more than 3.

You can transfer money to unlinked cards at any time once.

Options for tracking unintentional spending

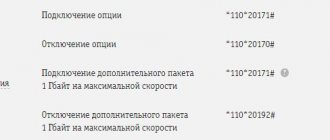

- The bank manages the auto payment. Beeline responds by offering Autopayment. The concepts are equivalent, but the places where options are controlled differ. Autopayment is activated using the bank’s services; autopayment is enabled using Beeline means:

- Personal account my.beeline.ru (Menu → Payment and finance → Autopayment). Alternative way: Menu → Payment and finance → Top up your account.

- Application (Menu → Finance → Payment tab → Autopay).

- USSD *114#, disable options: No secret code: *114*0#

- *114*0*secret_code#

detailed instructions

Using your personal account my.beeline.ru.

Service activation

During the process, the bank threatened to withdraw 10 rubles, but in reality the account remained the same. Perhaps later...

- Fill in the fields (card number, expiration date, mailbox).

- Press the yellow button.

- The bank page will open: Beeline checks liquidity.

- Enter the received SMS (phone number linked by the card issuing bank).

- The card is connected.

Secret code

After activation, Beeline will send a secret code. Remember the numbers, otherwise the reverse process (unlinking) will become much more complicated. You'll have to visit the office.

Deactivation

- After visiting your personal account my.beeline., follow the paths indicated above (equivalent).

- Click Change settings→ Unlink card.

- You will need a secret code (see above).

- Enter the numbers, press the yellow button.

- Ready!

Types of "Autopayment"

“Autopayment” involves several different Beeline options, in which money is withdrawn from the card. But, in addition, Beeline also provides services for replenishing an account on loan for several days. This “Autopayment” will also allow you not to be left without money in your account at the most necessary moment. Moreover, after connection this will be done automatically.

The amount by which your account will be replenished directly depends on the amount of money you spend on communications. If you do not spend more than 100 rubles per month, then “Autopayment” will be 30 rubles.

- From 100 to 450 rubles - 100 rubles.

- 450-1500 rub. — 300 rub.

- 1500-3000 — 450 rub.

- More than 3 thousand - 750 rubles.

But not everyone likes to borrow. It’s much easier to just link a bank card and not worry about running out of money all at once. Therefore, “Autopayment” from a bank card will be of interest to many.

You can connect it by calling the operator, using a special short command, or simply by visiting a Bank branch. You can also disable it through your bank, or you can use your mobile operator. We will tell you below how to disable Beeline Autopayment.