Autopayment on MTS: how to connect and disable

Attention! How to activate automatic payment for home Internet and MTS TV is written here.

Modern payment systems are increasingly offering users to top up their accounts or make automatic payments using bank cards. This way you can pay both bills for communication services and for using the Internet. This payment method is universal - it is beneficial for both the bank, the operator, and the subscriber.

What are the advantages of using auto payments from MTS?

— Convenient and comfortable service with a simple interface. — Saving user time. — “Clearing” the client’s memory of the need for a monthly payment. — Prompt receipt of funds to the operator. — Making payments from anywhere and at any time. — Availability of the service to both individuals and legal entities. — Inability to spend more money than planned (no extra write-offs). — The ability to perform a transaction of your choice: according to a given schedule, upon reaching a certain balance threshold, according to the amount of the invoice. — Ability to top up several phone numbers at once. — Reminder to the client about payment via SMS message 3 days before sending the funds.

How to connect and set up a digital number from MTS

First you need to make sure that MTS has the technical ability to connect digital television to the specified address. This can be done on the official website or at the sales office.

In order to connect, you need to go to the MTS website (mts.ru/personal) and leave a request indicating the address, date and time when it needs to be done. At the appointed time, a specialist will come and carry out the relevant work. Typically, the waiting time for connection does not exceed 3 days.

To be able to view programs, you need to sign an agreement with MTS. The paperwork is completed after the company specialist makes the connection.

The signal comes into the house via a separate coaxial cable. If the Internet is connected at the same time, then a different wire will be used for this. Watching television programs will not affect the quality of network access.

Technically, a tuner or a CAM card can be used for connection. In the first case, you need to connect it to the TV through the appropriate connector. The tuner must be connected to a cable that is routed into the house.

When using a CAM card, the cable is connected to the television receiver. To gain access to the Common Interface connector, an adapter is installed, and a card with a chip is first inserted into it, which provides access to paid channels.

Most modern TVs are equipped with such a connector. It may also be present on some tuner models. If the client does not have the necessary equipment, the company provides it for rent.

The connection is made with the TV turned off. After all devices are installed and the wires are inserted into their connectors, it needs to be turned on. In order to make the settings, you need to press the “Menu” button on the remote control.

When the menu opens, you navigate through it using the buttons that have arrows on them. First, the reception frequency and additional parameters are set in accordance with the requirements of the provider. After this, a search for available channels is started. After completing the setup procedure, you can start watching TV.

Types of auto payment

There are 3 options for setting up auto payment, let's look at them all.

By threshold

If automatic payment is configured according to a threshold of a given balance amount, then when the parameter is reduced, the bank receives an automatic request. If there is an amount on the client’s bank card that completely covers the payment amount, it is transferred to the operator’s account, and the client’s account is automatically replenished. In this case, the subscriber receives an SMS notification about the completion of the operation. If there are not enough funds on the client’s card, the transaction is canceled and the subscriber receives an SMS informing them that the transaction is impossible. Required data for making automatic payment at the threshold: telephone number; transfer amount; minimum balance threshold amount, bank card details.

Scheduled

If automatic payment is configured according to a schedule, then the money will be debited automatically on the specified day of the month and for the amount specified by the subscriber. If the required amount is not available on the client’s bank card, the operation is not carried out and the client is subsequently informed. Necessary data for making an automatic payment according to a schedule: telephone number, transfer amount, type of payment, time of receipt of funds on the balance, frequency of receipt of funds on the balance.

By account size

If autopayment is configured based on the amount of the invoice, it will be paid automatically on the day the subscriber has chosen. If the required amount is not available on the client’s bank card, the operation is not carried out and the client is subsequently informed.

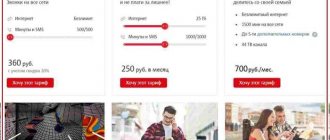

Tariff “We are MTS”

Internet, digital TV and mobile communications for the whole family - in one tariff! Connect up to 5 SIMs on the “We are MTS” tariff. The first month is free!

Service "MTS Money"

If you are a user of the service, go to your Personal Account and find the “Connect auto payment” tab. Specify the purpose of the payment and enter your bank card details. The subscriber is offered a choice of auto-enrollment type: balance threshold, schedule, invoice. Life hack: To limit the debiting of funds at a set threshold, it is best to indicate the maximum limited amount that can be credited to the subscriber’s phone account within a month. Automatic payment based on the invoice amount can also be used by subscribers who are already using the deferred payment service.

Application "My MTS"

Open the application and using the upper left button, select the “Billing and Payment” tab - “Autopayments” - “Connect”. The subscriber is offered a choice of auto-enrollment type: balance threshold or payment schedule. Specify the payment amount, the balance threshold amount and the automatic transfer date. Life hack: To limit the debiting of funds at a set threshold, it is best to indicate the maximum limited amount that can be credited to the subscriber’s phone account within a month. Attention: to confirm the possibility of the transaction and your registration in the system, an amount of 10 rubles will be debited, which will later be returned to your card. The funds will be transferred on the specified day of the month or when the amount on the phone account reaches below the established threshold.

Sberbank Online

You can connect directly in the Sberbank-Online service. This is a type of activation of automatic payment based on a balance threshold or according to a schedule.

“Autopayment” from Sberbank in facts and figures The minimum threshold for the balance on your phone account is 30 rubles. The daily maximum write-off balance is 10,000 rubles. The monthly maximum write-off balance is 30,000 rubles. The minimum monthly write-off limit is 300 rubles. The minimum deposit amount is 50 rubles.

How it works? When the minimum balance threshold of 30 rubles is reached or at a specified time, funds are written off in the amount set by the client, and your phone account is replenished with the subscriber informed via SMS.

What are the advantages of using automatic payment through the Sberbank-Online system? — transparency of transactions directly in your smartphone, — payment is carried out directly by the banking system, without intermediaries, — SMS control for each transaction performed to write off funds, — free connection to the service and maintenance (for Sberbank clients), — instant crediting of funds to the subscriber’s account.

We tested the MTS Money card. How to get the most out of it?

October 17, 201919119

MTS Money card is a new product. It comes complete with “goodies” that help you get additional income - one of them is cashback. Over the course of a month, we have been studying all the intricacies of calculating cashback, and at the same time, other features of the card, and now we are ready to answer the question: “Do you need to make this card the only “plastic” in your pocket?” A month ago, we told you about the “theoretical” pros and cons of the new MTS Money card, as the creators outlined them. Let us remind you that the main feature of the card is that its account is combined with the balance of the mobile phone number. You can read more about the conditions of unusual “plastic” here. The design of the card, its cost and the amount of cashback are, of course, important nuances, but what is much more important is how the card will perform in use. Therefore, in continuation of the previous article, today we will tell you how the month went with the MTS Money card in your wallet. So, I issued the card on August 30th. I contacted the MTS communication salon near the Kamennaya Gorka metro station (Pritytskogo St., 93).

Considering the fact that the card “went to the masses” only on August 28, the MTS employee was unable to immediately answer all my questions and consulted several times by phone. This fact did not cause any complaints from me - the product is completely new. In general, I spent about 10 minutes in the MTS office, and after receiving the card I was warned that it would not work immediately, I would have to wait about an hour. I did not check the veracity of the specialist’s words and went home.

I made my first card payment the next day, it went through without any problems, and I received an SMS message on my phone about the debit transaction. The message contained information about the place of payment, amount and account balance. Let me remind you that SMS notifications on the card are free. In principle, the card works like an ordinary contactless plastic card, and the MTS Money application can be compared to some kind of banking mobile application - it allows you to make a payment, transfer, and generate a statement. In general, it would seem that everything is the same as always, and a person who is accustomed to banking products should not have any discomfort, but I personally experienced it. At first it was difficult to get used to the fact that the balance of the phone and the card are a single whole. If you put some amount on a regular card and did not make any payments, then the balance on the card does not change, but in the case of MTS Money, it turns out that it is reduced by charging the subscription fee for the tariff plan!

And one more thing, it’s psychologically uncomfortable to transfer a large sum to a mobile number after you’ve topped it up with 20 rubles a month.

But as it turns out, it’s all a matter of habit. After some time, you stop paying attention to these nuances. I’ll tell you more about the MTS Money application. In principle, it is not bad, it has the most necessary set of functions, but from time to time it freezes terribly. For example, you log in via Touch ID, the system accepts the fingerprint, but instead of instantly logging in, you stare at the screen for 10 seconds, waiting for something to happen. For this reason, I used the application only to generate statements - by the way, you also have to wait for them, in my case it usually took about 5 minutes - very slowly. When testing, I used an iPhone 7. Perhaps newer models will behave differently. But this is exactly the result I got. The card balance can be found using the USSD request “*100#” in the “My MTS” or “MTS Money” application. In addition, the card balance is indicated in SMS messages about expense transactions. And here’s an interesting point: in the “My MTS” application, the balance for some reason differs by 1 kopeck!

Please note that all screenshots were taken at the same time

1 kopeck is, of course, a trifle, but still very strange. When you pay with a card, you get 5% cashback, which you can then spend on MTS services - if you actively use the card, you can avoid paying a subscription fee for . I immediately advise you to estimate the amount you want to receive, because all excess simply burns out in a month. For example, in my case I need 17.56 rubles for a subscription fee and about 3 rubles for . To get this cashback, I need to spend 411.2 rubles using the card. I note that this amount should not include money transfers, utility bills and some other transactions for which cashback is not accrued. The list of exceptions is in the first article, it is quite standard.

When estimating the amount with which you will receive cashback next month, it is worth remembering that transactions may take several days to be processed. Therefore, if you made a purchase, for example, on September 30, then the cashback for it will come not in October, but in November!

I received cashback for September on October 1 - I was confused by the fact that they did not inform me that it was already available. In other words, you can only find out how much you earned over the past month yourself, through the USSD request “*100#” and in the “My MTS” application.

In addition, neither the statement nor the account details indicate the total cashback amount for the past month. It turns out that if you don’t check it yourself on the 1st, you won’t know the final amount, because from the 2nd the subscription fee will begin to be charged from the cashback. For September I received cashback in the amount of 18.1 rubles. It turns out that the reward was calculated on the amount of 362 rubles, and I slightly underfulfilled my quota

When you receive the first cashback, the subscription fee for communication is debited from it, and not from the phone/card balance

You can estimate how much cashback will be credited based on the results of the month using the “History” section in the “MTS Money” application - the amounts for all completed transactions are displayed there, and the system automatically distributes them into categories.

This section will help you figure out what you can count on next month, but you still won’t be able to calculate cashback down to the penny. Firstly, because the total amount may include transactions for which cashback is not credited. Secondly, as we said above, transactions made at the end of September can be counted for October, and, conversely, those that you made directly in October, only at the end of the month, will not be counted. Using the card, I periodically studied the information in the “MTS Money” discussion thread on one large forum. It was interesting what people wrote about it, and what difficulties they encountered. So, situations were often described when a person topped up the card and after some time went to the store for shopping, but there were not enough funds on the card. Such problems are especially common on weekends; apparently there are some problems with crediting money. The most interesting thing is that in a month of using the card I have not encountered this even once, and have already considered myself one of the lucky ones, but, as it turned out, it was in vain. Just last weekend I deposited about 20 rubles on the card, and I was surprised that I didn’t receive an SMS about the receipt of funds, although it always came. I checked the transaction history in the mobile application through which I transferred money - you never know I transferred money to the wrong number, but I didn’t find any errors. Then I went to “My MTS”, it turned out that the money was already on my balance, and I calmly went to the store near my house.

But at the checkout there was an unpleasant surprise - “Insufficient funds” and I realized that this time my luck had left me. It’s good that I had a card from another bank with me - I didn’t have to return home empty-handed, but this situation, of course, is not the norm.

By the way, I never received an SMS about the receipt of funds, but the next day I paid with a card without any problems. If you believe the card statement, these 20 rubles were credited only at about 9 am the next day, i.e. 15 hours later! In general, I had mixed feelings about using the card. It is not without both minuses and pluses. Liked:

- The card is replenished easily and free of charge

- 5% cashback is awarded for transactions

- income tax is not withheld from the accrued remuneration

- free SMS alerts

Did not like:

- cash withdrawal only with commission

- transfer to another card only with a commission (not ERIP)

- You can replenish a card, account, deposit, as well as repay a loan through ERIP, for free in the amount of up to 1 thousand rubles per month, otherwise there will be a commission

- Cashback can only be used within a month

- no information about the monthly cashback amount

- problem with depositing funds on weekends

Many may attribute the cost of the card as a disadvantage, because it only works in tandem with, which costs 10 kopecks per day - it turns out that you will need to pay approximately 3 rubles per month for the card. Now let’s estimate that if you sign up for another card with cashback, cheaper or even free, and then connect SMS information to it, then most likely you will still get the amount of “3 rubles per month”, or you will receive something... something like that. You can, of course, not enable information, but this is, at a minimum, unsafe.

In my opinion, given the substantial cashback and free alerts, the card’s price is quite reasonable

In general, I don’t plan to close the card yet, but it hasn’t become a “favorite” for me either:

- You should not use your card to withdraw cash.

- It’s inconvenient for me to make payments through the MTS Money application; I never became friends with this service. Yes, and as it turns out, there are problems with the transfer of funds

Therefore, for me, the MTS Money card is a good option to recoup the subscription fee for communications, but, just in case, there is always other “plastic” in my wallet. Plus, don’t forget that there is no point in spending more than a certain amount per month on an MTS card - otherwise the cashback will simply burn out.

Do you want to share your financial experience, give advice on how to properly handle money, express your opinion about banks or organizing a business? Send materials to . We will publish the most interesting ones

Source: www.infobank.by

How to disable MTS auto payment

The main advantage of MTS is their flexibility and loyalty to the client. If you have activated a service or used an option, but for some reason they are no longer relevant to you, you can always disable them. And do it in the most comfortable, fastest and safest way for yourself. When choosing a deactivation method, be guided by the method by which you activated this service: using a bank or operator. Let's take a closer look at how to disable .

MTS personal account

If you are a registered MTS user, use the LC services. In your Personal Account, you can disable it completely free of charge: - go through the authorization operation on the website, - follow the tabs “Account Management” - “Autopayment” - “My Autopayments”, - select the linked bank card and disable it. Confirmation of the operation is accompanied by entering a code that the system will send to your smartphone

Application "My MTS"

The procedure is the same as when using your Personal Account on the company’s official website, but the use of a computer or tablet is not required: follow the “Account Management” - “Auto Payment” - “My Auto Payments” tabs, select the linked bank card and disable it. Confirmation of the operation is accompanied by entering a code that the system will send to your smartphone.

USSD request

System commands are one of the simplest and most convenient ways to disable the autopayment service. To deactivate, send the command *215#, and you will receive an SMS notification about successful deactivation.

Disable MTS auto payment from Sberbank card

Through Sberbank-Online Deactivation in this way can be carried out both through the application on the phone and using your banking page on the Internet. Procedure: log in to the bank’s website or application, follow the sections “Payments and transfers” - “My payments” - “Autopayment”. — select the “Disconnect” button with confirmation. A confirmation SMS will be sent to your phone number.

In the office If it is impossible to use the methods described above, you can always contact the Sberbank call center hotline specialists by calling 8 800 550 550 55. To disable the service, you will need the details of your passport and linked bank card.

Through Sberbank ATMs To deactivate the service, you need to visit the nearest Sberbank banking terminal and perform the following actions on the spot: - insert your bank card into the ATM and enter the password, - select the category “Mobile Bank - “Autopayments”, - select the cellular operator MTS, - select the “Disconnect” button, - confirm your choice, - do not forget to remove the card from the terminal upon completion of the operation.

SMS message To deactivate the function, just send a message like “Autopayment+blank+dash+space+your phone number+last four digits of your bank card” to the short number 900. For example: “autopayment - ХХХХХХХХХХХ”.

Source

Methods for connecting to the service

There are several connection methods, each of which may be convenient in a particular case. Neither the terms of use, nor the commission or other indicators depend on the chosen connection method.

Connection methods:

Using USSD command. Dial *111*123# on your phone and press call. After a few seconds, the operator will ask you to select the amount and other conditions.- Using MTS Service. You need to go to the service and dial the command *111*123#, after which - “call”. As in the previous case, the system itself will offer available options.

- In the "My MTS" application. You need to go to the “Bills and Payments” section, then go to the “Zero Opportunities” tab. Here you will see all the methods available to the subscriber on how to call when MTS is in minus or top up the balance. Among the services you need to select the one you need and follow the instructions of the application.

- Short number 1113. You need to call the short number 1113 and follow the instructions.

- MTS personal account. You need to log into your personal account, go to the “Payment” section and find the desired function among those offered.

You can activate the service in any way only once. An exception is made for subscribers who spent more than 500 rubles last month. for mobile communications. An increased limit of 800 rubles is available for them. and the ability to take payment twice. The total amount of all payments taken should not exceed the maximum threshold of 800 rubles.

Payment tracking and payment

The payment period for borrowed funds has been reduced from 7 to 3 days, forcing you to more carefully monitor the situation on your mobile phone balance. The operator offers several ways to track funds taken from MTS.

- Using the “Connect Manager” or simply dial *111*1230# on your mobile phone and press the call button. The answering machine will dictate all the necessary information.

- Call the short number 11131. To use this method, short numbers must not be disabled or prohibited on your mobile phone.

- Personal account on the MTS website. You need to find your account, go to the “Payment” section, select the service used, then click on the “History of promised payments” item.

When the personal account is replenished, funds will be automatically debited for the service, including commission. Funds can be written off partially if the required amount is not enough to become a plus. If the deposited funds are sufficient, the payment and interest on it will be fully repaid automatically, after which it will again be possible to go into the negative. If within three days the account is not replenished with an amount sufficient to fully repay the loan and interest, then the phone number will be blocked until it comes out of the red.

How to disable?

If you decide to disable the credit payment method (return to the advance payment method), you need to top up your account to a positive balance and send a USSD request *150*0#.

Filling out an application for the provision of a credit payment method means agreement with the “Regulations on the procedure for providing a credit payment method for communication services with subscribers of Mobile TeleSystems JLLC.”

1.1. This Regulation defines the conditions and procedure for providing subscribers of Mobile TeleSystems JLLC (hereinafter referred to as MTS) - individuals (hereinafter referred to as Subscribers) with a credit method of payment for MTS services.

1.2. The credit payment method is a form of payment for Subscribers under the Agreement for the provision of services (hereinafter referred to as the Agreement) and is a method of subsequent payment for MTS services made by the Subscriber at the end of the reporting period for their provision (calendar month).

1.3. Different payment methods (advance and credit) cannot be provided simultaneously for one personal account.

1.4. MTS has the right to unilaterally change these Regulations by publishing relevant information about changes on the official website www.mts.by.

1.5. This Regulation contains special conditions for the provision of a credit payment method, which take precedence in case of discrepancy with the Procedure for provision. In all other cases not regulated by these Regulations, the Subscriber and MTS are guided by the provisions of the Agreement concluded between the Subscriber and MTS and the Procedure for the provision of services.

“In full confidence” - calls with a negative balance

How many people are there in your life that you can trust? Trust your lives, your conversations, your minutes? MTS offers its subscribers a new level of communication - based on complete trust.

This service allows you to make calls with a negative balance, that is, “go into the red”, while remaining in touch.

The initial “minus” limit is 300 rubles; subsequently, the threshold for an acceptable negative balance is calculated based on the total amount of communication expenses and the period of use of the service. Connection and monthly use are absolutely free!

What does the limit amount depend on?

The initial “minus” limit is 300 rubles; subsequently, the threshold for an acceptable negative balance is calculated based on the total amount of communication expenses and the period of use of the service. When using the service for 120 days or more, the minimum limit will be equal to the amount of the monthly payment for communication + 20% of this figure.

The limit is increased monthly and one-time if: - you have paid your communication bill on time and in full. - the amount of your communication expenses has increased compared to the previous month, - the difference between the current threshold and the updated limit amount is more than 50 rubles (if the updated limit is less than the previous one, the maximum value is used). The amount of the “minus” limit is reduced to the initial amount of “-300” rubles if the invoice for the month issued under the terms of the tariff was not repaid on time. To fix or recalculate the limit amount, use a USSD request to the number *111*2136# or Personal Account.

Conditions

The service is available for connection to all MTS subscribers, except corporate ones, and tariff lines “Cool”, “Guest”, “Basic”, “MTS Connect”, “For laptop”, “For tablet”, “MTS iPad”, “Resort”, “Your Country”, “Smile+”, “My Friend”.

Connection is possible subject to the following conditions: - continuous use of tariffs for individuals for three months or longer with an average amount of credits of at least 200 rubles per month, - no debts on the personal account at the time of connection, - no debts on other MTS personal accounts for a period of more than 30 calendar days. When included in an already connected package tariff, the connection conditions depend on your tariff plan; it is also possible to change the tariff. Disconnection occurs if the subscriber does not use communication services for a month or more, and the calculation of monthly payments changes back to advance payment.

Attention! The monthly payment is calculated using the deferred payment method, which is not valid.

Let's figure it out. How to avoid paying for mobile communications?

September 4, 20198173

In the series of articles “Let's figure it out!”, we talk about different banking products, their pros, cons and important nuances. All the most complete information in one place and no small print! Today we will go through the new MTS Money card piece by piece. The rest of the articles in the “Let’s figure it out!” series search here. On April 10, Dabrabyt Bank together with the mobile operator MTS presented the “MTS Money” card. The editors of the portal infobank.by waited with bated breath for the commercial launch of this product in order to understand all its intricacies and tell you. By the way, we ourselves were wondering what they could do? And now it has happened - from August 28, any subscriber of the MTS mobile operator can get a card.

More about the map

“MTS Money” is a non-personalized debit card, which means that your name will not be indicated on the card and you can get it immediately when you contact MTS cellular communication stores.

| Basic conditions stated upon release | |

| Card type: | Mastercard Gold |

| Currency: | Belorussian rubles |

| Term: | 3 years |

| Cost of issue and maintenance: | for free |

| Service in the MTS Money service | 10 kopecks per day |

| Contactless payment technology: | Yes |

| "Buns": | money-back 5% |

Let’s immediately clarify the issue with the cost of the card - the “plastic” itself is issued and serviced free of charge, but the card can only be used when connecting to the MTS Money , the subscription fee for which is 10 kopecks per day. In other words, for a month the card will cost you about 3 rubles.

| The main feature of the MTS Money card is that its account is combined with the balance of the mobile phone number! |

In this regard, it is worth remembering that if the number is blocked, then you cannot use the card. A little information about what kind of blocking happens.

| partial | occurs with the advance payment method, if the negative balance on the account does not exceed 2 rubles |

| forced | occurs with the advance payment method, if the negative balance exceeds 2 rubles, or 30 full days have passed since the onset of partial blocking occurs with the credit method of payment, if the invoice for the last month has not been paid |

| the device is lost | installed at the request of the client in case of loss of the SIM card or loss/theft of the phone |

| voluntary | established at the request of the client for the purpose of temporarily suspending the use of services |

| examination | for example, can be installed at the request of the enforcement department |

Using the MTS Money card, you can pay at retail outlets and on the Internet, make a transfer, pay for utilities, withdraw money from an ATM - in general, carry out all the same operations as with the most ordinary bank card. “SMS notifications” are also automatically connected to the card , for which no fee is charged. In addition, MTS Money can be connected to the Samsung Pay service!

Decor

To become a card holder, you need to contact one of the offices of the mobile operator MTS, so far only in Minsk. By the way, on the MTS website there is a complete list of all points where you will be issued a card, so before you go to the nearest one, check whether it is on the list. Card registration is available to MTS subscribers subject to the following conditions:

- an individual has been an MTS subscriber for more than 30 days

- the subscriber is served under any tariff plan, except for “Fixed Internet” and “Super max” for foreign citizens

- the subscriber has reached 18 years of age at the time of issuing the card

- The card is issued if you have a valid passport of a citizen of Belarus or a residence permit

- the card is issued if there are funds in the subscriber’s personal account - if you have an advance payment method, there should be at least 30 kopecks left in the account, and if it’s a credit card, there should be no minus

Only one card can be issued for one subscriber number!

Replenishment, cash withdrawal, transfers

As we said above, the card account and the balance of your mobile phone are essentially the same thing. In other words, you simply top up your mobile number, and this amount becomes available for payments by card; accordingly, there will be no fees for replenishing the card . Withdrawing cash from a card is only possible with a commission, and its size will depend on the currency in which you are withdrawing money:

- Belarusian rubles at bank cash desks and ATMs – 3%

- foreign currency at bank cash desks and ATMs – 3% + 6 rubles

A transfer to another card can be made in the MTS Money application, through a third-party transfer service, or through ERIP. In the MTS Money application you can transfer funds between VISA and Mastercard cards, the commission will be 1.5% (minimum 49 kopecks). By the way, this application is an alternative to a mobile bank; through it you can track your card balance, view transaction history, and make payments. If you transfer funds through other services, the commission will be much higher - 2% + 6 rubles, in addition, a commission of the service in which the transfer is made may be charged. In addition, the transfer can be made through ERIP; you will need the recipient's account / agreement number. You can top up cards, accounts, and deposits for free up to 1 thousand rubles per month. When this limit is exceeded, you will be charged a commission of 1.5% of the amount, minimum 1 ruble.

Money back

When paying with an MTS Money card, you will receive a money-back of 5% of the transaction amount.

The reward can only be spent on MTS communication services using the number for which the card is issued!

Money back is credited once at the beginning of the month and must be spent before the end of the current month. For example, you paid with a card throughout September, at the beginning of October you will receive a refund, which must be spent before 23:59:59 on October 31; otherwise it will reset to zero. Please note that most often transactions are processed over several days, so if you made a purchase, for example, on August 31, then the money back for it will come not in September, but in October. There is a list of exceptions, which includes operations for which money back is not accrued.

| MCC codes for which money back is not credited: | |

| 4812 | Telecommunications equipment, including telephone sales |

| 4814 | Telecommunications services |

| 4829, 6050, 6531 — 6538 | Money orders and traveler's checks |

| 4900 | Utilities – electricity, gas, sewerage, water |

| 6010, 6011 | Cash withdrawal transactions |

| 6012 | Financial Institutions - Trade and Services |

| 6028 | Operations in Internet banking (payments, transfers) |

| 6051 | Non-financial institutions – quasi-cash |

| 6211 | Securities – Brokers/Dealers |

| 6529, 6530 | Replenishment operations |

| 6540 | POI funding transactions (excluding MoneySend) |

| 7299 | Various services - not classified anywhere else |

| 7800 | Government Lottery (US only) |

| 7801 | Online gambling (US only) |

| 7802 | Horse/Greyhound racing (US only) |

| 7995 | Gambling transactions |

| 9311 | Tax payments |

| 9399 | Government Services - Not Classified Elsewhere |

| 9402 | Postal services (government only) |

| 9700 | Automated Referral Service (VISA only) |

| 9701 | Visa Credential Verification Service (VISA only) |

| 9702 | Emergency Services (GCAS) (VISA only) |

| 9754 | Gambling, paying bets |

In the MTS Money application, you can order a statement, which will indicate the MCC code under which the operation took place.

| The directory of MCC codes can be found here |

When we saw that the card provided for a money-back of 5% of the amount, doubt immediately arose: would income tax be withheld from it? Let us remind you that if the size of the money back exceeds 2%, then income tax is withheld from the excess amount. However, in the case of the MTS Money card, the reward is not quite a money-back in the traditional form, because in essence you do not receive real money that you can spend at your discretion. You are awarded a bonus that can be spent exclusively on communications, so you don’t have to worry about taxes.

Now let's do some simple calculations

The card will cost us about 3 rubles per month. It turns out that in order to recoup its cost and break even, you need to pay 60 rubles a month with the card. Whatever you spend on top will be your profit. As already mentioned, you can only spend money back on MTS communication services, so let’s calculate how much you need to pay with a card in order to never pay for operator services again? The cost of the subscription fee is different for everyone, for example, for the author of the article - 17.56 rubles per month, and do not forget about 3 rubles - the cost. We think...

(17.56 + 3) / 5% = 411.2 rubles

It turns out that if you pay with a card for about 410 rubles per month, then you won’t have to pay for the operator’s services; their cost will be covered by money back.

| Please note that this scheme will work if 410 rubles does not include utility bills, transfers and other operations for which money-back is not accrued! |

If you do not go beyond the limits of your monthly fee, and you have enough minutes and the Internet included in the tariff, then there is no point in putting a large amount on the card, because the accrued money back can only be used for a month - then it expires! Therefore, if your average monthly spending on the card is about 600 rubles, the remaining 189 rubles can be put on another card with money back and get benefits there as well.

Bottom line

The MTS Money card is a truly interesting and unique product for Belarus. Pros of the card:

- replenishment is simple and without commission

- free SMS alerts

- can be connected to the Samsung Pay service

- solid money back size – 5%

- income tax is not withheld from the accrued money back

- among the MCC codes for which rewards are NOT accrued, there are no popular categories, for example, grocery stores

Disadvantages of the product:

- For now it is possible to issue only in Minsk

- actually costs 3 rubles per month - not the most budget option

- cash withdrawal only with commission

- Money back can only be used for a month

Having studied all the conditions of the card, we had an irresistible desire to apply for such “plastic” and evaluate its advantages, and perhaps disadvantages, from our own experience. We have issued a card, and throughout September we will pay for purchases with it, and then we will share with you our impressions of what it is like “in practice.”

Source: www.infobank.by