Reasons for closure

When a company client contacts the office to block a payment instrument, an employee asks about the reasons for this need. Among the main possible reasons are:

- Loss of plastic. In this case, the procedure turns out to be necessary for the safety of the money on the balance sheet.

- Purchasing services from another commercial organization. An account in the old company may not be needed when opening a new one in another bank.

- Theft of plastic. Also required to maintain safety.

- No need for a debit card.

Closing is best carried out after consultation with a company representative, since in this process it is necessary to take into account all the nuances.

Unlocking the SIM card

Often, the owner simply loses the phone due to inattention or forgetfulness. But soon the phone is suddenly found, and before that the vigilant subscriber had already managed to block it. Here a slightly different question arises: “How to unblock a previously blocked number?”

Currently, there are enough ways to unblock, and it is important to note that blocking does not in any way affect the account itself. It continues to exist, only the subscription fee is not charged during this period and other paid services are no longer charged.

How to unlock a SIM card on MTS?

To remove a previously installed lock, the following steps must be taken:

- Go to the required section in the Internet Assistant interface.

- Blocking using MTS service through a combination *111*157# ;

- Using a service called “Mobile Assistant” by calling 1116 .

- Making a call to a specialist.

- Visit the nearest company service.

Unlocking SIM

You can remove the lock in the following ways:

- Request assistance from the operator by making a call.

- Apply your Personal Account on the company website.

- Contact the service point closest to you.

There is an easier way: if you have already blocked your phone, call 0890 and notify the operator that you want to remove this blocking. Before doing this, be sure to prepare your passport information, which you will need to provide to the consultant over the phone for confirmation.

If you have difficulty calling operators, go to the nearest service office. There are many such points in the capital; in each region you can find many MTS offices.

If you are far from such services, live, for example, in a settlement, perform the unlocking operation on the Internet. Go to the website and go to the “Internet Assistant” link. Here you will not need your passport information. Use your username and password and use the system.

Features of closing and list of documents

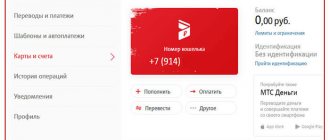

In order to close an account with MTS Money, you must write a corresponding application when visiting the office. To save time, it is recommended to download it in advance, fill out and print. Thus, it is also possible to send it to the company by mail.

In order for a bank account to be quickly and smoothly cancelled, there must be no debt on it. To make sure that they are not available, it is recommended to call the company’s office in advance. In order for the client to have the grounds and right to close the MTS Bank card, he must receive documentation containing:

- seal of a commercial organization;

- manager's signature.

After receiving the documents in hand, you must carefully review them for any inaccuracies. Papers generated with errors may subsequently be invalid.

How to unblock an MTS number?

Methods for unlocking an MTS SIM card independently depend on the main reason. Whether the user himself would like to no longer use the card. Or it is not active as a result of financial debts, due to mechanical damage.

How to unblock an MTS number after voluntary blocking?

After voluntary blocking, to unlock the MTS SIM card you must use one of the options:

- through your Personal Account (preliminary input of the requested system data for registration);

- get help from managers;

- call the hotline, describe the situation and follow the steps that the specialists will tell you about;

- at dealers.

How to unblock an MTS number after being blocked for non-payment

The blocking for non-payment is removed after the amount requested by the operator is credited to the SIM card - the amount of the debt. The debt is checked by the following dial: *132#.

Automatic blocking of the SIM card by MTS

The operator blocks in the following cases:

- The client does not call from this SIM card.

- the subscriber did not top up the account due to debt;

For one reason, SIM blocking does not take into account the possibility of restoration while maintaining the previously valid phone number. To continue communication you need to buy a new one. Before deactivating the card, the owner receives a warning message. The client has some time to make a final decision and fulfill the conditions for continued service by the operator.

Methods for closing an MTS Bank card

For convenience, the commercial organization has created conditions for fast and comfortable customer self-service. Therefore, today all closing procedures are significantly simplified and have several methods.

How to close an MTS Bank card via the Internet

Using the Internet or a specialized smartphone application is the easiest and fastest way to close the plastic. For the procedure, you need to log in to the system, then select the appropriate payment instrument in the section and the “block” option. In the same way, this can be done through a smartphone application. No documents or additional information are needed for the operation.

Office visit

This method is no more complicated than blocking through the “Personal Account”, but requires the client to be present at the company’s office and fill out an application, which will be provided by the manager. On the day of the visit, the holder will have the opportunity to pay debts on the account (if any) through the card. However, in the future you will need to visit the commercial organization again, but after forty-five days. Then, in the personal presence of the client, the plastic will be cut with scissors.

By phone

You can block a product by phone without leaving your home. In this situation, you will need to contact the contact center at one of the numbers:

- 8 (for all subscribers);

- 0890 (for cell phones).

It is enough to dictate to the specialist only your passport data, as well as the so-called code word. It is strictly not recommended to disclose your PIN code and other confidential information to company employees. Blocking in the absence of debts and other difficulties will be completed on the same day.

When is a card blocked?

If the client cannot find the bank card in his wallet, most likely the card was lost or stolen.

To avoid possible troubles and fraudulent activities, you must immediately block the card. Do not neglect the blocking procedure, because until you notify the bank about the loss of your card, responsibility for all transactions lies with you. After you cancel the plastic card, responsibility for the safety of funds passes to the bank.

How to disable "Autopayment" when connecting it in Sberbank

We suggest that bank clients who have activated services through the services of a financial institution consider other methods. You can disable the service through Sberbank tools:

Disconnection in Sberbank Online

You can disable automatic payment in the mobile application on your smartphone, or on the official website page at www.sberbank.ru. Use this algorithm:

- Go through the authorization procedure.

- Go to the "Payments and Transfers" tab.

- Select the block called “My Payments”.

- Here you will see the “Autopayment” item, tap on it.

- Click on the “Disable” button and confirm this operation.

- Confirmation occurs by entering the code from the received SMS on the phone.

At Sberbank ATMs

To disable the service, use a simple procedure:

- Insert the card into the terminal, enter the PIN code.

- Click on the “Mobile Bank” block.

- In the new ATM window, select the “Autopayments” section.

- Specify the mobile operator "MTS".

- Use the shutdown button, and be sure to confirm the action.

Through Sber's internal messaging service

To work via telephone and without Internet access, you can use the bank’s special number 900. You should send a message to it. Everything is written with spaces. Enter one by one:

- The word "Autopayment".

- Place a Dash sign.

- Enter the phone number where you want to disable auto-replenishment.

- The last 4 digits of the bank card.

How to remove the lock after entering an incorrect PIN

The SIM card functionality includes a PIN code that must be entered when turning on the phone. If you enter an incorrect combination, the SIM card is blocked, but not permanently. You can return it to functionality by entering a special PUK code. This is usually an eight-digit number that is indicated on the starter pack card.

When prompted for a PUK code, you must enter the data correctly. After this, the phone will prompt you to enter a new PIN. Be sure to write it down in a safe place. If you cannot remember your PIN, we recommend turning it off in your phone settings. Also, don't try to enter PUK at random. After 10 incorrect attempts, naturally, it will be impossible to unlock the SIM card.

If the starter pack is lost, you can find out the PUK combination from your operator by calling 0890 or 88002500890 (for calls from a landline). The subscriber will need to provide data that confirms that he is the owner of the number. The consultant may ask you for the latest information about your balance or about incoming/outgoing calls for the last period.

We also recommend contacting an MTS communication salon. Bring your passport with you to confirm your identity.

If the card has not been activated

All banks send cards inactive. It's just plastic with an inactive account. To start the process, the client must take a mandatory action - call the MTS Bank hotline and complete the activation. Only after this the payment instrument becomes valid and various operations can be performed with it.

If you have not made the card active, you can do nothing. The account is not valid; nothing can be debited from it for services and maintenance. Therefore, you can simply forget about plastic. It is valid for 3 years, the expiration date is indicated on the front side of the card. While the term has not expired, the card can still be activated. Once finished, the plastic will become unusable.

MTS employees can activate the card upon issue. You may not even know about it. If you have a question whether your card is activated or not, please contact the bank’s hotline 8800 250-0-520.

Introductory information

Without going into the reasons for your desire, we will advise you: do not read reviews about the bank and turn off your emotions.

Don't read reviews because satisfied customers don't write reviews, and you won't find anything other than negativity. You should turn off your emotions so as not to rashly throw away or cut the plastic. If your card is found, then criminals can use it, even if it is cut. In addition, according to the banking agreement, any card is the property of the bank and is issued for temporary use. To correctly close a credit card, as well as a debit card, it must be returned to the bank. That is, you need to return the card to the bank so that they can ceremonially cut it into pieces! But nothing can be done, the contract requires it - the client does it. By the way, in modern card service agreements the section “the client has the right” or something similar is completely absent, and information about your rights must be collected bit by bit. In the MTS Bank agreement (conditions for receiving payment and credit bank cards), the rights of the bank itself are mentioned much more often than the rights of the card holder. However, we, as clients of the bank, have the right to terminate the contract with him, and we will look at how to do this correctly in this article.

To completely “reset” your relationship with the bank, with the most favorable outcome, it will take at least a month and a half. Surprised? Yes, exactly 45 days in advance, according to the terms of the agreement, the client must notify MTS Bank of his intention to close the card. This period is established if the parties do not have any controversial issues regarding card transactions. If such occur, then 45 days are counted from the date of resolution of these most controversial issues.

Mobile app

If you actively use mobile applications from a cellular company, then the auto-payment service can be blocked directly in the program itself.

My MTS

1 Go to the application and select the “Connect auto payment” panel:

2 A list of connected automatic payments will appear on the phone screen. Click on the line with the green indicator:

3 On the page that opens, activate the “Disable” button:

4 Autopayment will be switched to inactive state:

5 After 1-2 seconds, a notification about service deactivation will be sent from the server to your phone:

Easy payment

1 Enter the main menu and select the “Autopayments” category:

2 Click on the line with active automatic payment:

3 Select the “Disable” panel:

4 Confirm your decision to refuse the service:

5 After a few seconds, a notification about disabling autopayment will appear on your phone screen:

And additionally you will receive an SMS with the same text.

Visit the branch of the bank that issued your card. Show the operator your passport and tell the card number on which you want to disable automatic payment on MTS. A few minutes after identifying you, a bank employee will fulfill your request.

If you do not have time to visit a banking institution, call the hotline number indicated on the back of the card. Dictate your passport details to the operator and inform him of your refusal to automatically top up your mobile account. After specifying your card details, the bank employee will disable the unnecessary option.

ATM

You can block the auto payment service without the help of a specialist at an ATM. The main thing is that it belongs to the same financial institution that issued you the card.

- Please login.

- Select from the main menu or “Mobile Bank”.

- Click on the “Autopayments” panel.

- Find the MTS mobile operator in the list.

- Activate the "Disable" button.

Online wallet

If your mobile balance is automatically replenished from an electronic wallet, then you need to cancel the service in the payment system itself. Let's consider the procedure for disabling autopayment using the example of the Yandex. Money".

1 Log in to your e-wallet and click on the “Autopayments” category:

2 A list of active automatic payments will appear on a new page. Click on the line with the MTS logo:

3 A window will open on the right with a detailed description of the connected service. Activate the “Customize” button in it:

4 And then select the “Disable” function:

5 In a couple of seconds, a letter will be sent to your mailbox informing you that your auto payment has been blocked:

Incorrect PIN entered

If you do not disable the code verification function on your smartphone (or other device that supports SIM cards), then each time you reboot the SIM card you will need to enter a four-digit password. After three unsuccessful attempts, the device is locked for security reasons.

In this situation, you need to find the envelope where the SIM card was stored at the time of purchasing it in the store and enter the PUK written on the envelope.

Hint: usually the required set of numbers is located on a separate insert or directly on the plastic card a little below the PIN.

Over the years, such not particularly important documents may get lost. Don't be upset!

The codes can be found out by performing simple manipulations:

- send an SMS to number 9999 with the form 375 __ ____ __ __ (space) code word. When concluding an agreement with a telecom operator, company employees were required to ask to come up with a secret word just for such situations. (It is also stated in the contract);

- call 8-800-250-0890 or the shortened version in the video 0890;

- on the official website of the campaign after going through a series of procedures;

- go to the nearest MTS communication salon, the employees know what to do in such a situation and will definitely help.

Voluntary blocking

If the card is lost or simply because it is no longer needed, like any other MTS operator, it provides the service of voluntary deactivation of the SIM card. For example, this service is often used if they go to a place where they will not use it for more than six months. The advantage of this function is that the number is saved for the subscriber. If you need to restore, you will not need to call your friends to announce new contacts.

In this situation, there are 3 solutions:

Advice: prepare your passport in advance and remember the code word. The operator will definitely require this data from you.

Blocking by telecom operator

When drawing up a contract, one of the clauses indicates that the operator reserves the right to unilaterally block a number for a number of reasons:

- zero or negative balance for a long period of time;

- outstanding invoice;

- not using a SIM card for a month to six months (calls, connecting services, etc.).

By calling the call center, operators, when voicing the personal account number, can voice the reason for blocking the account.

In the case of a long-term negative account, you simply need to pay off the debt and wait a while for the transaction to be processed.

It should be remembered that it is impossible to restore a forgotten card that has not been used for more than 2-3 years (check with the operator). Since the number is reissued and goes on sale again.

Some tariffs provide for a period of use of no more than 180 days and are designed for people who frequently travel on business. In this situation, it is impossible to restore the SIM card. Operators or salon employees will tell you more about the tariff.

It is worth considering that the campaign has the right, in case of prolonged non-payment of debt, to recover the necessary amount by going to court. MTS usually sends a warning letter to your mailbox about this intention.

This article discusses the most common ways to unlock an MTS SIM card yourself. Many of the methods do not take much time and require only one call or a walk to the nearest communication store. With the second option, we advise you to immediately find out about the current tariffs, since often tariffs connected more than 1-2 years ago are less profitable and “flexible” compared to new ones.

Terms and service rates

Each bank client or potential cardholder can apply to connect a mobile bank to their phone. The official application can be downloaded to any smartphone based on iOS, Android, Windows Phone absolutely free of charge.

After signing an agreement for remote banking services, an SMS will be sent to the client’s number with data for the first login: account login and password. Subsequently, they must be changed in the service settings. You can use the application at any time, without restrictions.

Using USSD command

MTS, you can remove it from your phone using the system command. This method is suitable for any subscriber, because to perform it, you do not need to have Internet access, register anywhere or call anywhere. To disable the function, all you need to do is have a cellular device on hand and know the short code.

USSD request deactivating this option – * 215 #. Immediately after sending the code combination, an SMS will be sent to the number notifying you that the service has been deactivated.

Results

The MTS SIM card can be temporarily blocked either at the request of the subscriber if he has lost his phone or plans to temporarily not use it, or by the provider. If a SIM card is blocked at the request of an MTS subscriber, you can restore it for free within two weeks. After this period, a fee for maintaining the number begins to be charged - a ruble per day. Regardless of the reason for blocking, you can restore your SIM card quite easily and for free. The operator offers to issue a new card both if it is faulty and if it is lost. It is possible to restore it for free even if the subscriber has forgotten the security passwords from it, but you can simply request your PUK code from the operator. If there is a financial reason for the suspension of the number on the part of the provider, in order to continue using it, it is necessary to pay off the debt. It is worth keeping in mind that not all operations will become available immediately. For security reasons, full use of the number becomes available within a day if you changed the SIM card after blocking.