Beeline has lost third place in the telecommunications market in terms of the number of subscribers, industry sources told Izvestia. According to the results of the third quarter of 2021, the operator’s subscriber base decreased by a record 9% in recent years, it follows from the reporting that it invested insufficiently and untimely in the construction of networks, which led to a deterioration in the quality of communication services, analysts say. This will intensify competition between companies, and the possibility of price wars in certain regions cannot be ruled out, experts say.

Communications market

In the thirty years since its inception, the cellular communications market in Russia has reached the stage of oversaturation, and in recent years, cellular operators have been busy searching for new sources of growth. The pandemic has accelerated this process.

The golden era of cellular communications ended in 2012. Then the Big Four operators (MTS, Megafon, Beeline and Tele2) simultaneously recorded a drop in their subscriber base. A year later, “mobile slavery” was abolished, which for some time gave operators the opportunity to expand their base by luring subscribers with better offers. Then the companies relied on MVNO (Mobile Virtual Network Operator) - virtual cellular operators, which were supposed to “shake up” the stagnant cellular market. Thus, on the basis of Tele2, virtual operators Sbermobile (Sberbank), TTK Mobile (Russian Railways), Tinkoff Mobile (Tinkoff Bank) and others started working on the basis of Tele2. Megafon has collected the largest subscriber base in the MVNO field thanks to Yota. The virtual operator MGTS started working on the MTS network. But even here, judging by experts, there have been no great successes. So far, the share of virtual operators, as Kommersant previously reported, is slightly more than 1%, and they do not have a serious impact.

Meanwhile, cellular penetration is increasing. At the end of 2019 in St. Petersburg and the Leningrad region, according to the consulting agency Advanced Communications & Media, it grew to 263%. The pursuit of a share in connections does not bring new revenue, nor does reducing prices for services, unlimited tariffs, and package offers with increased volumes increase it; in order to maintain their market share, its players need to predict consumer demand trends as accurately as possible and quickly adapt to new trends. The operators' initiatives are aimed at ensuring that the client is satisfied with the service and receives personal offers. At the same time, the basic needs of customers remain the same, and operators need to ensure network coverage and communication quality, and a high level of service.”

To meet the demands of the times, operators have been actively exploring IT, media and other related markets in recent years. Almost all of them have special offers for music lovers, digital TV, OTT services, financial services, Big Data, Internet of Things (IoT). “Even before the pandemic, we updated our own business strategy, which is focused on creating a full-fledged ecosystem of digital products around the needs of the client,” reports the St. Petersburg branch of MTS PJSC. “For example, MTS is the only company that has all the TV signal transmission media: cable TV, IPTV, satellite and OTT. One part of this system is the creation and distribution of exclusive content, which will strengthen our competitive advantage.”

On average, all these additional services (Value Added Services, VAS), thanks to which cellular operators are trying to go beyond traditional telecom, collectively, according to AC&M Consulting estimates, amount to up to 13% of mobile service revenue (excluding data transfer in mobile networks) . “Both businesses and private clients are moving to the digital environment. As a result, the need for high data transfer speeds, traffic volumes and communication quality is growing. Businesses vitally need digital tools to organize work in new conditions. The winner is the one who adheres to this strategy,” Mr. Titov is confident.

However, tangible commercial successes of VAS are still a matter of the future. For now, the telecom market is slowing down. If in 2017 and 2018 the growth, according to the analytical agency TMT Consulting, was 2.7 and 3.3%, respectively, then in 2021 it was only 2.1%, and the total market volume was 1.73 trillion rubles. And the main share of industry revenue so far is formed by the mobile communications segment - up to 60%.

According to Leonid Delitsyn, an analyst at Finam Group, by the end of 2020, MTS revenue will increase by 2% and amount to 502 billion rubles. “However, Rostelecom can also lay claim to the status of the largest Russian telecom operator by revenue, which both increased revenue and accelerated the growth rate thanks to the acquisition of Tele2 (Rostelecom and Tele2 began merging in May 2021, the deal was closed in May 2020 .— BG

), explains Mr. Delitsyn. — The state operator’s revenue according to IFRS in the third quarter increased by 13% compared to the same quarter of the previous year, to 135 billion rubles, and for nine months amounted to 383.9 billion rubles. The company itself expects revenue growth by 9% for the year.” According to the analyst, in the optimistic scenario, Megafon's revenue will increase by 2% compared to last year, to 340 billion rubles. The revenue of the Russian division of VEON may decrease by 4.4%, to 279 billion rubles.

“Telecommunications are the largest sector of the global ICT market, accounting for 37.6% of all high-tech revenue. However, Gartner expects a decline in revenue in the sector as a whole for the year by 3.3%, to $1.326 trillion. In 2021, the sector will recover, but will not fully compensate for the fall,” notes Mr. Delitsyn.

Accelerated by the pandemic

The already difficult situation in the industry, despite the expected growth of individual players, has been aggravated by the pandemic. The Content Review agency estimated the losses of mobile operators in the period from March to May 2021 at approximately 30 billion rubles. Although, in addition to the disadvantages associated with the loss of roaming income due to the closure of borders and 30-50% of the retail network, there were also advantages. “The pandemic forced enterprises to transfer a large share of employees to remote work, and the self-isolation regime led to an increase in demand for online shopping, entertainment and, in general, to a surge in the use of digital services,” says Megafon PJSC. This increased interest in services that operators had previously been developing for several years. According to MTS, an analysis of the digital activity index based on Big Data revealed that the popularity of online cinemas and streaming services among St. Petersburg residents has quadrupled compared to last year. “We see an accelerated transformation of media consumption and understand how relevant it is to separate media into a separate business area,” says MTS PJSC.

Perhaps, as a plus of the pandemic, one can also consider the postponement of the implementation of the “Yarovaya law”, which obliges telecom operators and Internet companies to store records of telephone conversations, SMS and Internet traffic of users for six months, by a year. More precisely, a postponement of the norm on an annual increase of traffic storage capacity by 15%. Previously, operators reported how much this storage would cost them: thus, taking into account the size of the business, MTS estimated its expenses from 2021 to 2023 at 60 billion rubles, Megafon at 40 billion, and Beeline at 45 billion.

Development prospects

Operators have great hope for 5G. This means almost instant access to cloud services, video streaming, multiplayer cloud gaming, augmented and virtual reality shopping, online remote collaboration and much more, experts say. “For people, life is concentrated in the smartphone: they use it to communicate, work, and make purchases. The digitalization trend will only deepen, and the need for telecom services will grow. There will be no large-scale return to offline after the end of the pandemic. Digital is with us forever,” says Mr. Titov.

In July 2021, MTS became the first operator to receive a license to provide mobile communication services in the new format. However, both the company itself and other market participants, as the media wrote, see many problems in the frequency range allocated for 5G that will not yet allow the creation of a commercially successful network. If problems with frequencies are resolved, analysts expect widespread use of 5G in Russia by 2025, when more than 40 million people will be able to use the technology. Until then, the new standard will be deployed only in the corporate segment, experts believe.

Mr. Delitsyn agrees that the main driver of industry growth should be the spread of the 5G standard, but for now this, according to him, belongs to the future. The next few years will focus on possible market consolidation. “This year, the share price was most strongly affected by the successful consolidation of acquired companies. For example, news about the successful integration of Sprint usually leads to an increase in the share price of the American T-Mobile (TMUS). Over the year, the share price increased by 59%, from $80 to $127. And in Russia, over the year, the shares of Rostelecom, which completed the takeover of Tele2, went up by 10%,” says the expert.

Anzhelika Tikhonova

Three decades without a wire

Milestones

Next year, cellular communications in Russia will celebrate its thirtieth anniversary. BG correspondent Anzhelika Tikhonova recalls the main milestones of development.

1991

- created in September in St. Petersburg. Communication was carried out using the analog standard NMT-450 (1G standard). Thanks to the company in Russia, on September 9, the first call took place on a cell phone, which weighed 3 kg, between the mayor of the city, Anatoly Sobchak, and the mayor of Seattle;

— in December, a cellular network was created in the capital of Russia. Until 2005, work was carried out in the NMT-450 (and NMT-450i) standard.

1993

- in June, North-West GSM was created in St. Petersburg (since 2002 - Megafon);

- in August Bee Line GSM was created, which worked under this name until 2005, becoming Beeline;

— MTS was created in October.

1994

— the American AMPS standard (1G standard) appeared in Russia. Like NMT, AMPS was an analog technology, but it offered higher network capacity, which was important in the face of growing numbers of subscribers;

— in June, according to a decree of the Russian government, it was necessary to obtain permission from Gossvyaznadzor to use mobile phones. In its absence, the fine ranged from 15 to 70 minimum wages (from 1251 to 5838 rubles at that time);

- the emergence of GSM (2G) networks, which brought roaming between operators and SIM cards. Before this, SIM cards did not exist; changing the telecom operator was only possible through reprogramming the phone.

1998

— operators refuse to charge fees for incoming calls.

2000

— registration of all mobile phones with Gossvyaznadzor has been cancelled;

— GSM operators provide the ability to connect to the Internet via the WAP protocol.

2001

- GPRS (2.5G standard) appeared - the first mass protocol for connecting to the Internet.

2002

— the number of landline and mobile communications subscribers in Russia equaled and amounted to 35–36 million people (70–72 million in total). At the same time, 30 thousand settlements are still not connected to telephones.

2003

— in Russia, Tele2 begins to operate in the GSM standard after the Swedish holding of the same name purchased the Russian assets of Millicom, an American-Swedish company that, since the 1990s, has created cellular operators in Russian regions using the D-AMPS standard;

— Sky Link was created on the basis of Moscow Cellular Communications. It works using GSM and CDMA technology, which is developing in parallel with GSM.

2004

- the emergence of EDGE - a technology that is considered a further step in the development of GPRS. It helped increase data transfer speed.

2006

— mobile penetration in Russia has reached 100%.

2007

- in May, the Yota company appeared in Moscow - the first operator in Russia operating on the basis of a new data transmission technology at that time - WiMAX;

— in October, Megafon launches the first UMTS (3G) network in the country in St. Petersburg.

2010

— Yota announced plans to switch from WiMAX technology to LTE (4G standard). A year later, the first LTE network in Russia was launched in Novosibirsk.

2012

— Big Four operators simultaneously recorded a decline in their subscriber base;

— VimpelCom (Beeline), MTS and Megafon sign an agreement on the joint development of mobile commerce in Russia.

2013

— in December about: subscribers can switch to any operators while maintaining their phone number.

2014

— for the first time in the history of the industry in Russia, the revenue of mobile operators is declining.

2016

— the beginning of the digital transformation of the telecom industry.

2018

— On July 1, the Yarovaya Law came into force, which requires telecom operators to store call recordings, correspondence, videos, images and other communications of subscribers for six months.

2019

— From June 1, intranet roaming has been cancelled.

2020

— in July, MTS received the first license in Russia to provide mobile communication services in 5G format;

— Rostelecom closed the deal to purchase Tele2;

— in October, the Russian government postponed until September 2021 the norm of the Yarovaya Law on an annual increase of traffic storage capacity by 15%.

Control is more important

“We can safely say that the Russian mobile communications market is innovative and is not inferior to the markets of Western Europe,” says Denis Kuskov, CEO of TelecomDaily.

The most needed options, according to the analyst, are cost control, filtering of unnecessary voice traffic and ease of use of all these services. The simpler the internal system of the operator’s platform is built, the easier and more convenient it is for the average subscriber to use, he notes.

The Russian market can truly be called innovative from the subscriber’s point of view, agrees TMT Consulting CEO Konstantin Ankilov. The review takes into account additional services that make mobile communications more comfortable, he noted. The analyst pointed out that the main areas of innovation for mobile operators today are at the intersection of IT and telecoms and media. This also includes the Internet of Things (IoT), cloud solutions, information security products, etc.

Changes in competition between operators

Until 2021, the main method of competition between operators was to reduce prices. But as 2021 brought lower revenues, the mobile phone companies made an unspoken “reconciliation” agreement. Operators decided to abandon the dumping policy and switch to subscriber retention.

This strategy has had a positive impact on the mobile communications market. So, for example, in the 3rd quarter of 2021 there was an increase in revenue, while for the same period in 2021 operators were in the red.

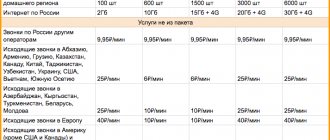

Market shares and main financial indicators of mobile operators at the end of 2021

Details Parent category: Mobile operators Category: Russian mobile operators

Recent years have been marked by stagnation for mobile operators.

But in 2017, companies began to take decisive steps towards changing their strategy towards digitalization. This turn was forced for mobile operators. After all, to survive as an industry, they simply need to think about strategic shifts. Digitalization of business occurs differently for each player. In competition, each company chooses its own strategies for interacting with digital. But it is worth noting that all participants are on equal terms. After all, it is still difficult to say which path will be the most advantageous.