Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Mobile operator Megafon regularly creates new options and offers for its customers. This makes cooperation with the company profitable and convenient.

Special conditions are provided to regular and corporate clients. One of the popular options is lending - providing a sum of money to the subscriber’s balance.

Let's look at how a loan is provided at Megafon and to whom the service is available.

Conditions

The conditions for cooperation with the company in obtaining loans for the client are as follows:

- loans from the company are provided only to its regular subscribers who have sufficient experience of cooperation with the company;

- To receive a loan from Megafon, the client must be a regular subscriber for the last year;

- obtaining a loan is possible when the client sends a request for a loan to the company in the entire requested form;

- To receive a loan from the company, the client must confirm that he is of age;

for a company client to receive a loan on his phone, the amount in his account must be more than 5 rubles;

How to take it and register?

Applying for a loan from Megafon implies that the client must comply with the following sequence of actions:

- submit a request for a loan to the company by sending an SMS message to the specified number or submitting a written application for a loan to one of its branches;

- indicate the expected loan amount to be received during personal communication with the company;

receive an SMS message on your phone indicating the company’s decision to issue a loan or refuse it;

Online application

Submitting an application for a loan online means that the company’s client needs to register on the official website of the Megafon company and leave a request for a loan on it.

When submitting a request, the client must accurately indicate the length of time he has been a client of this organization, as well as accurately indicate the amount to be received and the expected time, as well as the method by which the company will provide the loan.

After consideration of the application and its approval by the company, an SMS is sent to the client’s phone number indicating the amount ready for disbursement and the timing of the loan.

In addition, at the request of the borrower, the loan amount can be sent by this structure to his telephone account with his consent for subsequent use at a certain percentage.

If you are looking for information about loans with a bad credit history and arrears for the unemployed, we recommend reading the article.

A draft agreement on the provision of a loan by the company for a pre-agreed amount is sent to the client by mail for review and signing.

How to register with MegaFon Bank

Please note that the personal account of a Megafon subscriber and the personal account in Megafon Bank are two different things. The registration process in the online service takes literally a minute:

- Go to the main page of the service https://bank.megafon.ru/;

- In the upper right corner, click on the “My Bank” button;

- Enter your phone number (starting with number 9);

- Create a password and enter it twice;

- Wait for the SMS message with the code and enter it in the appropriate field;

- Next you will find yourself on the main page of the online service.

Registration with Megafon Bank does not automatically lead to the issuance of a card and does not impose any financial obligations on you.

Company offers

The Megafon company makes the following loan offers to clients:

| Company offer | Loan amount | Loan disbursement terms | Bid | Notes |

| Loan to Qiwi wallet | From 500 to 30,000 rubles | From one day to one month | From 0.35% per day | To process a loan, the borrower must have been a subscriber of the company for at least one full year. |

| Loan to a bank account | From 1000 to 25000 rubles | From one day to 21 days | From 0.65% per day of loan use | Elimination of debts on the loan provided can be performed by the client at any time convenient for him before the end of the loan period |

| Cash loan at a company branch | From 500 to 28,000 rubles | From one day to four weeks | From 0.65% per day | Refunds are also possible by depositing cash at the cash desk of any branch of this company. |

| Loan on Yandex money | From 500 to 20,000 rubles | From one day to 24 days | From 0.85% in one day | Repayment can be made in cash or by depositing funds from the client’s wallet in the Yandex system |

Megafon loan on card

Receiving a loan from this company on a card can be carried out under the following conditions:

- For one week. The amount of the entire transaction is accepted in an amount from 500 to 4500 rubles, issued at a rate of 0.5% per day. Cards from all banks in the country are suitable for obtaining a loan.

- For 15 days.

The loan is issued in an amount of up to 15,000 rubles, at 0.75% per day.

It is also possible to pay off current loan debts by making payments from the client’s card on which the loan amount was received.

- For one month. The transaction amount is up to 30,000 rubles, at 1.2%. The terms of the agreement allow the client to repay the debt under the transaction at any time.

To phone

Telephone loans are issued under the following conditions:

- Up to 10,000 rubles. Issue is possible at 0.75% per day, for 12 days. The client can return the loan amount in any way convenient for him, or repay the entire loan amount with accrued interest.

- Up to 15,000 rubles. Issued for periods of up to two weeks, at 1.5%. It is allowed to repay the loan amount before the due date with interest or repayment at the discretion of the loan recipient.

- Up to 20,000 rubles. Provided for three weeks, at 0.65%. Early repayment is permitted.

Requirements for borrowers

The company's clients must comply with the following requirements when conducting transactions:

- It is mandatory for a citizen to send a request to the company for a loan.

- The borrower must be an adult.

- The client must have experience interacting with the company as its subscriber for at least one year.

- All documents related to the case had to be prepared by the client.

Liquidation of debt by the client had to be completed exactly within the specified time frame.

Types of cards from MegaFon Bank

The online service follows current trends, therefore it offers its subscribers not only a physical (plastic) card, but also a virtual one.

- Plastic card - supports contactless payment method, has a PIN code;

- Digital card - you can add it to your smartphone and pay for purchases from it (the device must support NFC technology). A digital card has lower limits compared to a plastic card. This is done for the safety of your funds.

Payments

The following loan repayment options are available:

In addition, the client has the right, at his own discretion, to repay the loan amount issued to him with interest, if the loan was received by him on his telephone account.

You can familiarize yourself with the rules for drawing up an interest-free loan agreement from an organization to an employee here.

Advantages and disadvantages

Loans from Megafon have certain advantages and disadvantages.

Their advantages can be considered:

- When receiving a loan for a phone, the client is temporarily not charged for the company’s services.

- The loan amount can be received by the borrower in any way he chooses.

- You can apply for a loan from the company completely online.

The terms of the loan agreement can be increased by the client at his own request.

Negative aspects of such a loan:

- Loans are issued only to clients of the company if they have the requested length of cooperation with it.

- Loans carry high interest rates.

- The company's fines for delays are quite significant.

- Obtaining loans is only possible for adult clients.

- Checking a client’s data to determine whether a company can issue a loan can take quite a long time.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

Video: Borrow money from an operator

Credit of trust

Another way to receive loans from a company is to enable an option called “Credit of Trust”. This function allows you to use the funds for a fairly long period of time. Even if the client’s balance is negative, he can send SMS, make calls, and access the Internet.

The preferential threshold is calculated as follows:

However, this option has one undeniable condition compared to the promised payment.

Since it is provided under the following conditions:

- There is no subscription fee;

- connection fee - no;

- There is no disconnection fee;

- There is no payment for obtaining information.

"Credit of Trust" has some main features:

- it can only be used by individual subscribers using commercial tariff plans - it is not available to corporate clients;

- if any amount is deposited into the balance, it will be increased by the appropriate amount - in this case, it is possible to maintain a balance between the standard and preferential threshold (the subscriber will not be disconnected);

- if the balance becomes negative during use, then it is mandatory to repay the debt before the 25th of the current reporting period - otherwise, the option simply will not be provided in the future;

- if within a month from the moment of connecting “Credit of Trust” the client’s balance was below the disconnection threshold, it occurs automatically.

How to transfer a loan to Zolotaya Korona? Find out by following the link.

It should be remembered that liability for non-repayment of borrowed funds is minimal - most likely, Megafon will not take the case to court, since the amount of the state duty will be greater than the debt.

But at the same time, subsequently, using the services of this mobile operator will be extremely problematic or simply impossible.

About company

Today it occupies a leading position in the provision of mobile information transmission services to the public. With more than 20 years of experience, Megafon can offer optimal cooperation options to all its clients.

The secret of the company's success and its high competitiveness lies in the following prerogatives:

- continuous improvement of software and use of the latest technologies;

- competent organization of internal processes and high focus on customer interests;

- using a more affordable pricing model and providing a wide range of additional services.

However, he does not plan to stop at the achieved high result. It has important tasks ahead to implement more ambitious plans to conquer the Russian market and expand its customer base.

Loan options on Megafon

Microfinance is just one of the areas of activity that allows its subscribers to receive additional financing without unnecessary problems and solve many everyday problems associated with an acute lack of financial resources.

The company offers the following microcredit options:

| Loan on Yandex.Money | The size of a mini loan varies between 500-20,000 rubles . The loan term can be from one day to 24 days . The interest rate is 0.85% per day. You can pay off debt obligations in cash or from your Yandex.Money wallet. |

| Loan to Qiwi wallet | It is a small loan in the amount of 500 to 30,000 rubles . The interest rate is 0.35% per day. You can borrow money for a period of no more than 30 days . A loan to a Qiwi wallet without refusal and certificate of average earnings is provided only to verified Megafon subscribers with at least 12 months . |

| Cash loan at the representative office | Microfinance is thus offered for a period from one day to 4 weeks in the amount of 500 to 28,000 rubles . The interest rate is 0.65% per day. Debt repayment is also possible in one of the branches. |

| Mini loan to bank account | Interest is calculated at a rate of 0.65% per day. The loan term varies from 1-21 days . The mini loan amount is 1000-25000 rubles . Early repayment of debt obligations is encouraged and carried out without penalties. |

| Loan to a bank card | Issued for a period of one week to one month. The loan amount per card varies from 500 to 30,000 rubles and depends on the chosen loan term. Interest rates range from 0.5-1.2% per day. |

| Loan for phone | The loan amount does not exceed 20,000 rubles . Interest rates vary between 0.65-1.5% per day. The loan term cannot exceed three weeks. The amount in the client's account must be more than 5 rubles . |

Name of service and terms of provision

A loan from Megafon allows you to perform all the necessary actions even with a negative balance:

- send SMS;

- send MMS;

- make any calls:

- within the network;

- to numbers of other mobile operators;

- to your home phone and abroad.

Today, you can borrow funds from a telecom operator in several different ways, using:

- "Promised payment";

- "Credit of trust."

Promised payment

Promised payment is a special option that allows you to use all the functions of the operator’s network if your account balance approaches zero.

At the same time, the conditions for the provision of the service depend on a large number of different factors, including the length of service as a subscriber, as well as monthly communication costs.

There is no limit to the number of times this option can be used within a month. The only condition is the repayment of debt to the operator for a previously incurred debt.

It is necessary to remember that for a loan of this type it will be necessary to pay:

A debt of 15 rubles is valid only for 1 day.

It is available if:

- balance more than −5 rubles;

- the amount for the entire service period is more than 100 rubles.

For other loans, the repayment period is 3 days. If the debt has not been repaid within the period specified in the conditions, the number will simply be blocked. Therefore, it is important to deposit the appropriate amount within the period specified in the conditions.

It must be remembered that in some cases the option of the type in question cannot be provided:

- when tariff options are connected: “Turbo button”;

- Megafon Tajikistan;

What does a client need to take out a loan?

To take out a loan from Megafon, the client needs to submit a request to the company for additional financing. This can be done via SMS notification or during a personal visit to one of Megafon’s offices.

After reviewing the request, an SMS will be sent to the client’s phone, which will indicate the amount of additional financing they can provide. Next, you will need to settle all paper issues and receive cash.

It is worth knowing that loans from Megafon are provided without refusal only in the following cases:

- the borrower must be a regular subscriber of Megafon;

- the client must be an adult and have documentary proof;

- the client must correctly formulate a request to the company for a loan.

How to get a loan using a passport online - read the link.

If you fail to make a payment

If during a mobile transfer the recipient's cell number was indicated incorrectly and the money went to the wrong account, you can try to return it. To do this, you need to print a check on the website money.megafon.ru/history/details/723415233801 and contact the cell phone store or technical support. there you need to log into your Megafon personal account in the money transfer system - for this you will need a password, which can be obtained by entering your phone number in the appropriate field on the website via the link.

If the erroneous number belongs to another operator, for example, Tele2, you only need to contact their cellular network. If there is an error in payment within the framework of mobile commerce, you need to contact the product and service company.

Connecting services to your phone

To activate this service, you must take into account that first of all the credit limit is calculated.

It can be determined by the following criteria:

- based on average communication costs for three months;

- according to the period of cooperation with this mobile operator;

- according to the tariff plan used for communication using this card;

- for additional options and services connected to this SIM card.

After all points have been checked for compliance with the requirements and an understanding has come of which limit should be chosen, it is recommended to use one of the following connection options:

| Enter the number combination on your phone | To activate the service, you need to dial *550*1#, then press call and wait for a message about the successful completion of the operation. |

| Send SMS message | To do this, you need to send the number 1 in the message and send it to number 5050. Or you can use an alternative method and send a message asking for connection to number 0500. |

| Calling the call center | This method is the simplest because it involves communicating with contact center specialists. To do this, you just need to call 0500 and ask the operator who answers to activate the service. |

In order to ensure maximum customer convenience, carrying out any of these operations takes a minimum of time so that you can gain access to using this service as soon as possible. If the connection was made through an operator, then you can always find out the reason for the refusal and all the details of using a loan on a SIM card.

How to repay a debt

You can pay your credit debt in any of the following ways: by credit card, through payment systems or terminals, etc. The only requirement in order to constantly be in touch is timely payment, which is paid within the specified period. Otherwise, the phone is blocked.

If it does come to this, then there is no need to be very nervous and panic. The phone is unlocked immediately after the overdue payment has been made.

Do not forget that the credit limit is recalculated once a month. Therefore, as the costs for a given number decrease, the limit and deferred payment period also become shorter.

How to top up your card account

It is worth understanding that the personal account of your card (it does not matter its type) is actually the balance of your phone number. Accordingly, you just need to top up the balance of your number. Thus, money can be spent from the balance of the number and from the card. The easiest way is to deposit money into your personal account in the online service itself using another bank card:

- After logging into Megafon Bank, in the “My Finances” section, click on the account replenishment button;

- Specify the amount you want to put on the card (from 100 rubles to 15 thousand in one payment);

- Click on the “Continue” button;

- Enter the number of the bank card from which you want to withdraw funds (Visa and MasterCard payment systems are supported);

- Confirm the payment according to the system requirements.

Account replenishment is possible in every Megafon communication store, through a terminal, or an ATM of any bank. All terminals and banks provide the opportunity to top up your mobile phone account.

Other ways to get money onto your card

You can top up your phone account without using credit from the operator with the help of friends who can give you money for this. Thus, using the appropriate service, you can make a request to top up your account completely free of charge.

allows you to send a free message to another subscriber so that he can top up his mobile account. It can be sent to any client cooperating with Megafon. This allows for five requests per 24 hours, but more than 30 messages per month.

To make an application, you need to dial the command “*143*lender number#call”. By the way, you can ask friends or relatives for a favor, even while roaming at the time. But for this it is necessary that such a request is supported by a partner of the required country.

How to connect

In order for all this to work, Mobile Transfer must be activated on your number. In most cases, it is included in the basic services provided free of charge by default. A commission is charged for the actual payment of money, depending on the method and direction. The fee is added to the original amount rather than subtracted from it.

In general, you don’t need to connect anything - just use any suitable payment option. But what if it didn't work? Either you made some mistake, or this service was blocked for your cell phone. Why could this happen? Possible reasons for blocking the service: fraudulent activities, suspicion of financing terrorist activities, inconsistency of passport data.

If the service was disabled earlier, you can connect it back in the following ways:

- Using the USSD combination *105*220*0# + “Call”;

- SMS message with the text “ 1 ” to 3311 .

All requests and messages to this number are free, like the service itself; the fee is charged only in the amount of the commission when making payments to another cell phone, bank card or other things that you top up from your Megafon account.

Advantages and disadvantages

| pros | Experts in the microfinance market highlight the following advantages of loans from Megafon: |

- Efficiency. You can receive funds on the same day of application very quickly. The only exception to the rules may be a transfer to a bank account. This operation is carried out within 1-5 business days.

- No need to go to the bank. You can receive funds to your bank card, Qiwi or Yandex.Wallet, phone, without leaving home, which is especially important for those people who are accustomed to value their personal time.

- A wide range of loan programs to satisfy the additional financing needs of a wide range of people.

- Lack of paper bureaucracy. Loans on Megafon are issued without documentary proof of employment. The only thing that is required from the borrower is to confirm that he is of age.

- Extended age limits. Loans on Megafon are issued from the age of 18 without guarantors, parental consent or collateral. Older pensioners also have access to additional financing on the same terms as other borrowers.

- Reasonable interest rates. You can get a loan on Megafon at 0.35% per day, which is very profitable, considering that many microfinance organizations issue mini loans at 2% per day.

How to take out a loan for maternity capital - read here.

The interest-free loan agreement from the founder is here.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Mobile operator Megafon regularly creates new options and offers for its customers. This makes cooperation with the company profitable and convenient.

Special conditions are provided to regular and corporate clients. One of the popular options is lending - providing a sum of money to the subscriber’s balance.

Let's look at how a loan is provided at Megafon and to whom the service is available.

MegaFon Bank technical support - hotline number

If you want to call specialists to clarify a question related to the online service, there are two numbers available for you:

- 5555

- 8 800 5505555

To write to specialists in an online chat, you need to log in to Megafon Bank, scroll down the page and find the “specialist” button. A dialog box will open where you can write your message and attach an image if necessary. A similar chat is available in the Megafon Bank mobile application.

The online service provides a “Questions and Answers” section: https://bank.megafon.ru/app/support. Please read this section first before contacting support. Because here you will find answers to the most frequently asked questions from subscribers.

About the organization

is the largest cellular operator in Russia. It has been operating in the market for more than 20 years, providing communication services in all regions of the country, as well as in Abkhazia, Tajikistan and South Ossetia.

The operator has more than 76 million subscribers, 90% of whom use the company's services regularly.

Megafon has many advantages:

- The fastest mobile Internet.

- Developed branch network.

- Tariffs for each type of gadget - phone, tablet, computer.

- Possibility of communication underground and in the sky.

- Communication is available anywhere in the country.

The company provides conditions for people to communicate through voice communications, SMS and MMS messages, and the Internet. The highest quality of communication makes the operator the most popular in Russia among individuals and corporate clients.

Existing loan programs

Megafon offers special programs that allow you to stay in touch even with a zero or negative balance.

These include:

- "Promised payment";

- "Pay when it's convenient."

You can also make a call at the expense of another subscriber:

- "Call me".

- "Pay for me."

- “SMS at a friend’s expense.”

- "Call at a friend's expense."

The last listed programs are suitable only if the subscriber has a positive balance on the phone and is willing to pay for communication. Few people use these services, only in exceptional cases when you need to make an urgent call and there is no money in your account.

“Promised payment” is a special service that consists of replenishing the balance with a small amount of money. The option is activated for a certain period, during which the subscriber must repay the debt and pay for the service.

The number of requests per month is not limited. But you can use the option again only after repaying the first loan.

When you connect the promised payment, an amount from 15 to 200 rubles is provided for a period of 1 to 3 days. The amount of payment depends on the time of use of Megafon services.

Let's consider the conditions for providing the “Promised payment” option:

| Amount of payment | Validity period, days | Commission | Conditions |

| 15 rubles | 1 | 3 rubles | balance is more than -5 rubles, over the past month at least 100 rubles have been deposited into the account |

| 50 rubles | 1 | 5 rubles | the user has been a Megafon subscriber for at least 1 month, the account was replenished with an amount of 100 rubles per month, more than 30 rubles were spent per month |

| 100 rubles | 3 | 10 rubles | The SIM card has been in use by the subscriber for more than 3 months, over the past period the account has been replenished with an amount of more than 150 rubles, monthly expenses exceeded 30 rubles |

| 150 rubles | 3 | 15 rubles | the subscriber has been a client for more than 3 months in a row, the account is replenished monthly in the amount of 150 rubles, monthly expenses exceed the amount of 200 rubles |

| 200 rubles | 3 | 20 rubles | the SIM card was issued more than 90 days ago, the balance is replenished monthly by 200 rubles or more, more than 250 rubles are spent from the balance |

It is worth considering that the funds received can be spent on any type of communication. This money cannot be cashed out or transferred to another subscriber.

For active and regular users of Megafon communications, the company offers a special “Credit of Trust” option.

It involves setting a certain shutdown threshold for a negative balance. This allows you to continue to use communication services even if your account has a minus.

The service is provided free of charge, subject to monthly spending requirements. If a subscriber spends less than 170 rubles per month on communication services, then the option is not available to him. You can calculate the available amount for the option on the company’s website.

Initially, up to 180% of your monthly expenses is available. For example, if on average over the last 3 months the client spent 300 rubles every 30 days, then the disconnection threshold will be -540 rubles.

The loan amount is recalculated monthly. And by increasing communication costs, the subscriber receives an increased loan amount.

When connecting to “Pay when convenient”, the “Promised payment” option is not available. Also, if the balance is negative and credit funds are spent, you cannot make a mobile transfer.

Option not provided:

- less than 3 months have passed since the SIM card was connected;

- more than one number is registered on the subscriber’s personal account;

- there is debt on other personal accounts;

- over the past 3 months, the amount of monthly expenses is less than 170 rubles per month;

- the “Promised payment” option is already enabled;

- the balance is below the provided credit limit;

- The number belongs to a corporate client.

Requirements for subscribers

Requirements depend on the option being connected. In general, you can use loan services if several conditions are met:

- The SIM card was activated more than 3 months ago.

- The subscriber actively uses communication services and replenishes his balance in a timely manner.

- The client has no debt on other numbers.

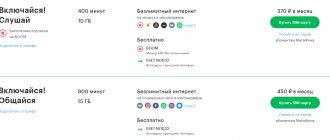

Card tariffs from MegaFon Bank

The telecommunications company offers its subscribers a choice of three tariff plans. Each tariff has its own subscription fee, which is charged every month. The cost of tariffs is quite modest - many banks have significantly higher monthly fees. Please note that all rates are available for both digital and physical cards.

Subscription service can be avoided if you maintain a certain cash turnover on the card every month.

The subscription fee is disabled for the following monetary turnovers:

- On the “Lite” tariff – from 3,000 rubles per month;

- On the “Standard” tariff - from 10,000 rubles. per month;

- At the “Maximum” tariff – from 30 thousand rubles. per month

The subscriber does not need to take additional actions to disable the fee. If the turnover is achieved, the fee will not be debited.

How to get a loan on Megafon

Before activating the option, you should read the terms of service and the contract.

As a rule, subscribers do not have any difficulties in obtaining a loan, but a detailed study of the document will allow you to immediately get answers to all questions.

You can enable this option in several ways:

| Personal visit | any company office |

| Call the operator | you will need to provide your passport details and code word |

| By sending a special command from a mobile phone | must be from the number on which you want to activate the option |

| By sending an SMS message | to the operator's number |

Submitting an online application

The mobile operator offers to control your expenses and connect options in your personal account. This is very convenient - the subscriber is always aware of the money spent, minutes, free SMS and traffic balance.

You can activate your personal account through your mobile phone, having received a unique login code, or at the company office.

To receive a loan or connect a promised payment, just select the required one. If the subscriber meets all the stated requirements, activation occurs instantly. Money is credited to your account within 1-2 minutes.

Thanks to your personal account, you can not miss the date of making your next payment. The system will indicate the expiration date of the service and offer to activate automatic payment. Using online services is convenient and profitable.

How to borrow on MTS, read here.

Service activation methods

To activate the “Promised payment” option, you must send an SMS message to number 0006 indicating the required amount. You can also dial *106# on your phone and then select the desired amount.

To activate the “Pay when convenient” option, you must do one of the following:

| Dial a command | *550*1# |

| Send SMS | with the text “1” to number 0500 |

| Next send an SMS with the text | “Please connect the credit of trust” to the number 0500 |

| Call 0500 | and then follow the instructions of the system |

Each option is available for connection:

- at any Megafon contact center;

- in the subscriber’s personal account on the company’s website.

After successful activation of the option, an SMS notification will be sent to the subscriber’s number indicating the timing of the provision of services.

Information about the amount of debt

In order to replenish your account in a timely manner, you must constantly monitor the balance of your phone number. When you activate the “Promised payment” option, all information is sent to the subscriber via SMS message.

It indicates the amount of the credited payment and the date of payment. Before the specified period, you must deposit an amount equal to the amount received plus a commission for connecting the service to your balance.

When receiving a loan, the format for displaying the subscriber's balance changes. By dialing *100#, the system sends a message indicating:

- Available credit limit.

- The total amount that can be spent (limit plus personal funds in the account).

- Balance (personal funds).

If the balance on the account is negative, that is, the subscriber used credit funds in the past period, then the message also indicates the amount to be paid and the date before which the payment must be made.

How to pay off debt

Payment of debt is made by crediting the required amount of money to the account in one of numerous ways:

- cash at terminals;

- in your personal account by transfer from a bank card;

- at any ATMs;

- transfer from an electronic wallet;

- transfer from a bank account or card via Internet banking;

- transfer from the number of another Megafon subscriber.

It is important to pay the required amount exactly on time. If the money is not credited to the balance by the specified date, the subscriber’s number will be blocked. And getting services in the future will be problematic.

If a subscriber has several numbers, then after a certain period of time the operator can withdraw money from the balance to pay off the existing debt.

Therefore, you should take your obligations responsibly so as not to spoil your relationship with your telecom operator.

Disabling methods are provided upon request only. It is not automatically connected. Therefore, there is no need to disable it.

But, if the phone balance is replenished before the write-off date, you can disable the option in advance. To do this, you need to send a message with the text “0” to number 0006.

After this, the amount of the promised payment and a commission will be written off. Early termination of the service does not affect the amount of the commission.

If the subscriber has activated the automatic promised payment option, then to deactivate it, you must send an SMS with the text “STOP” or “STOP” to the number 000600. The subscriber will receive a notification on the phone about the successful deactivation of the option.

To disable the “Pay when convenient” option, you must do one of the following:

| Send a message with text to number 0500 | “Please turn off the credit of trust” |

| Dial a command | *559*1# and press the call button |

| Send SMS | with the number “2” to number 5050 |

| Contact | to operators at 0500 or to any company office |

You can deactivate any option through your personal account. After successful disconnection, the subscriber will receive a message. You can reconnect services at any time, subject to all conditions and requirements of the company.

Advantages of cards from MegaFon Bank

- There is no bank card balance. The money on your card is the balance on your phone number. Accordingly, there are a huge number of ways to easily top up your personal account. And to get acquainted with the card balance, you just need to look at the phone balance. In fact, you can make a wide variety of offline and online purchases with the money from your number balance;

- 0 rubles for card issue;

- Several tariffs for your choice at a minimum cost;

- Interest is accrued on the account balance every month - up to 10% per annum;

- Availability of cashback. To get the maximum cashback of up to 20%, you need to make purchases from Megafon partners. For all other purchases, cashback is also credited in the amount of 1.5%.